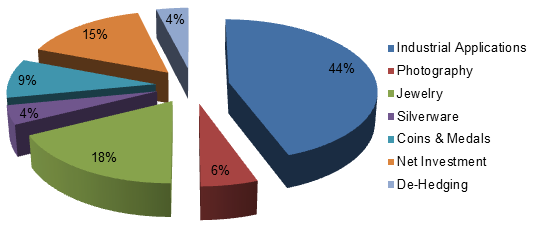

Silver is not a safe investment. Just because prices are low now does not mean the bottom is in . Investing in this metal is pure speculation with very little fundamental support. If the U.S economy stays strong silver has little upside and may lose speculation premium when interest rates are cut but if the economy collapses silver prices will crash along with every other commodity. . Investing in this metal is pure speculation with very little fundamental support. If the U.S economy stays strong silver has little upside and may lose speculation premium when interest rates are cut but if the economy collapses silver prices will crash along with every other commodity. …There is no reason for investors to believe precious metals like silver are any different, or somehow immune from the factors currently crushing the prices of oil and the other commodities. Right now we have crested the boom cycle and commodity prices are entering a long term bear market. On top of this, the economy of China is slowing and U.S GDP growth figures are constantly being revised downward. This does not bode well for silver, because demand for commodities depends on economic growth and if growth falters silver will fail. There is no glamour here, only cold hard facts. Most of the talk about silver centers on its usage as an investment vehicle, but investment is only a small portion of what drives the price of the metal. Silver is primarily an industrial and consumer discretionary ingredient, in fact over 70% of the metals usage is for economic output. This means only a tiny fraction of silver production goes toward investment, and most of this is metal is held by the silver ETFs and brazenly manipulated… Silver is primarily used in industrial applications, especially electronics…because it has the highest electric conductivity, thermal conductivity and contact resistance of any metal. To date no other substance can replicate the properties of silver cost efficiently and there is little risk of obsolescence at current prices. However, while silver's role in industry is unassailable it does not have this same strength in its other usages… Silver's usage: A tiny fraction used for investment

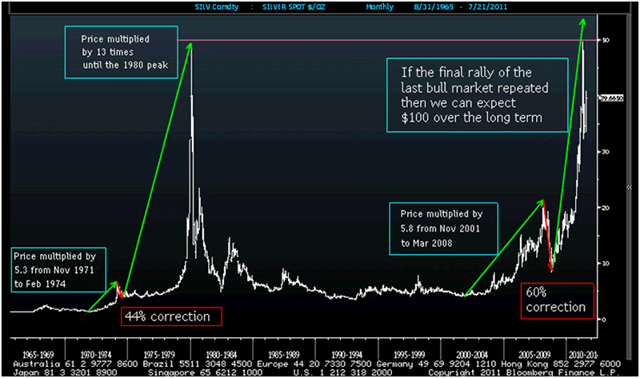

Solar energy is a bullish factor There are bullish factors for silver. The growing importance of solar energy (photovoltaic technology) provides an opportunity for growth in the metals industrial use. Silver demand in the energy industry has made up for much of the economic value it lost during decline of the traditional photograph technology it was once used in. Photovoltaic technology has been growing steadily in the U.S, especially after the government committed to over-investing in the late 2000's in the sector after the 2007 financial crisis…[which,] coincidentally, mark the height of the silver price bubble we saw around that same time. While this seems like a clear case of supply and demand determining prices, looking deeper into the situation reveals problems with this conclusion. A tale of two Bubbles Silver has had two major rallies in modern history both of…[which] were speculative bubbles with little (usually coincidental) correlation to the metals actual economic demand. Anatomy of irrational exuberance: Investors expected $100 silver

- The first modern silver bubble occurred in the early 80's as the Hunt brothers, two Texas billionaires, attempted to corner the silver market. They did this by buying massive amounts of the metal on the commodity markets with leverage. At the height of this attempt, these two men were able to control the 1/3rd of the entries worlds supply of silver, driving the price up the metal up 712% in a week.

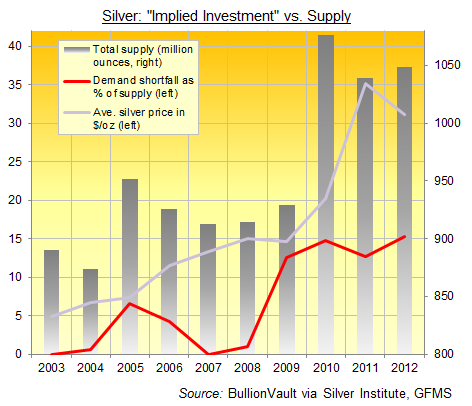

- The second silver bubble occurred in 2011 and was commonly assumed to be caused by supply shortages and increasing photovoltaic demand. This wasn't the case. Photovoltaic requires an ultra pure silver (.9999) which is not used as bullion and doesn't factor into the supply/demand situation for the common .999 and sterling physical. Backwardation and an unprepared bullion industry compounded the myth of a supply shortage.

The reality was that silver prices in 2011 where the result of a bubble in the commodities super-cycle instigated by QE. Retail investors where hoodwinked and many are still holding the bag. Supply chart, 2003 to 2012: shows large surplus during 2011 silver bubble

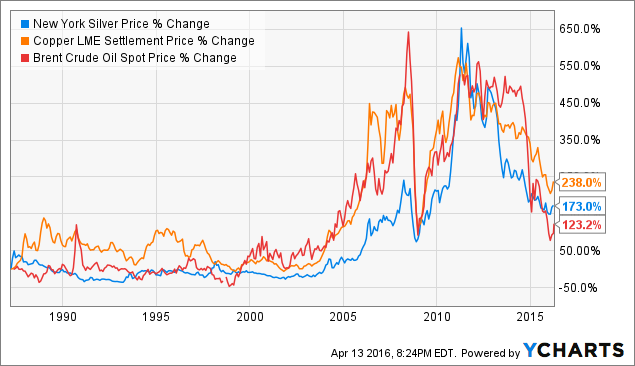

Correlation between silver prices and other commodity prices Commodities tend to move in lock step through what is called the commodities cycle. It tends to be correlated with the business cycle because a stronger economy means more demand for goods that require commodities for production… Because silver is a precious metal investors draw incorrect conclusions about the factors that drive its price. In terms of market risk, investing in silver is very similar to investing in oil, zinc or copper. If you believe silver can increase by 500%, as many precious metals investors do, I would like to hear your case for oil because whatever catalyst does this, if it is fundamentally based, will move all commodities. Being bullish on silver but bearish on commodities (in general) is like being long the NASDAQ and short the S&P 500. To illustrate, the graph below reveals that silver's price behavior mimics other commodities:

In the graph above we can see that when commodities go up silver also goes up, and when commodities crash silver follows them. Silver is not as closely correlated with other commodities, however, and I believe this is because of the massive speculative positions maintained on the metal. Note: As mentioned in the 2007 Traders Report, silver was the most shorted position in the entire world at that time. I believe this speculation suppressed the metals price from 2000 to 2007. The real cause of the commodity bubble In the years after the crash the Federal Reserve began its quantitative easing policy…[and] the prices of all commodities and equities became inflated beyond their economic value. I believe this was the actual cause of the silver, oil, copper and (as everyone knows) gold bubble… Just as stocks tend to move with each other in the equity markets. (think NASDAQ vs S&P 500) commodity prices do the same. However, while stocks can trade for a long periods of time based on speculation and future earnings the price of commodities is determined by one thing above all else; economic demand. When economic demand does not justify price a commodity will slowly sink back down to its cost of production. This is what recently happened to oil, and this is what will continue happening to silver. For this reason, any premium significantly above silver's cost of production (that cannot be justified economic demand) should be seen as a bubble because it will not last. Stop clicking around! #Follow the munKNEE instead Economic outlook and investor expectations The current and future economic outlook for commodities is not good, in fact they are trading at Great Recession level prices right now. This is despite the supposedly strong U.S economy. If and when the U.S economy goes into recession commodity prices will fall to levels we would have previously found unimaginable. This could be $20 oil and $7 Silver. I expect to see commodities trading at prices lower than average cost of production for several years before the market resets itself via supply side bankruptcies. Conclusion Silver is not a safe investment. Just because prices are low now does not mean the bottom is in. Investing in this metal is pure speculation with very little fundamental support…If the U.S economy stays strong silver has little upside and may lose speculation premium when interest rates are cut but if the economy collapses silver prices will crash along with every other commodity. Before investing in silver it is important to make sure the bottom has been reached before trying to catch a falling knife. We have a lot more time to wait before this metal hits its lowest point in this commodity cycle… Disclosure: The original article, by "Gold Bug", was edited ([ ]) and abridged (?) by the editorial team at  munKNEE.com (Your Key to Making Money!) munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read. to provide a fast and easy read.?Follow the munKNEE? on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

The post Silver Could Drop to $7 in Coming Recession! Here's Why appeared first on munKNEE dot.com. |