More Kale Smoothies On The Way Regardless of whether or not the Bank of Japan's statement this week is well received by the financial markets, the trend has been and will continue to be to print more in an effort to prop up an over-indebted global economy. China is a good example of the limitations of endless ?stimulative? kale smoothies. From The Economist: The country's debt has increased just as quickly over the past two years as in the two years after the 2008 crunch. Its debt-to-GDP ratio has soared from 150% to nearly 260% over a decade, the kind of surge that is usually followed by a financial bust or an abrupt slowdown. China will not be an exception to that rule. Problem loans have doubled in two years and, officially, are already 5.5% of banks' total lending. The reality is grimmer. Roughly two-fifths of new debt is swallowed by interest on existing loans; in 2014, 16% of the 1,000 biggest Chinese firms owed more in interest than they earned before tax. China requires more and more credit to generate less and less growth: it now takes nearly four yuan of new borrowing to generate one yuan of additional GDP, up from just over one yuan of credit before the financial crisis. With the government's connivance, debt levels can probably keep climbing for a while, perhaps even for a few more years. But not for ever. When the debt cycle turns, both asset prices and the real economy will be in for a shock. That won't be fun for anyone.

Gradual Shift To Helicopter Money

No central bank, including the Bank of Japan (BOJ), wants their policies to be associated in any way with the term helicopter money. However, given central banks are already engaging in direct-injection stimulus, including the Bank of Japan buying stock ETFs, over time a move toward purer forms of helicopter money is a high probability outcome. From CNBC: Citi has forecast a "gradual shift towards helicopter money" by advanced economies, as countries struggle to boost growth and inflation in uncertain geopolitical climes. The bank's report came as the Bank of Japan started a two-day meeting on Thursday, after which it is widely expected to launch another major stimulus program. Prime Minister Shinzo Abe is seen announcing a fiscal stimulus package as well, which a report by news agency Jiji put at 28 trillion yen ($267 billion).

Direct Move To Helicopters Unlikely Central planners in Japan have been doing a lot of talking recently, which means a disappointing reaction to the BOJ's statement is well within reason. From MarketWatch: The Bank of Japan starts a two-day policy meeting today and some investors expect it to team up with the government to announce more extreme stimulus measures on Friday. Prime Minister Shinzo Abe already said Wednesday that he is preparing a ¥28 trillion fiscal stimulus?much greater than previous expectations for a 10 trillion yen stimulus. Still a number of traders say the market may have priced in such expectations already, setting investors up for disappointment.

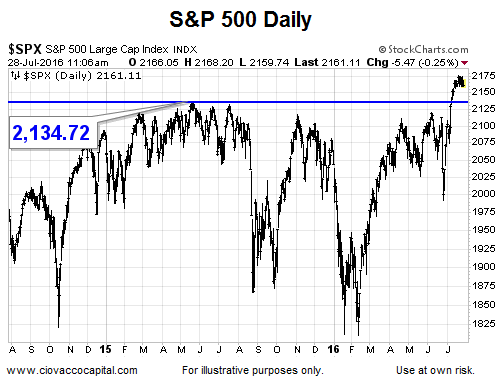

It becomes a bit easier to comprehend the S&P 500 pushing to new highs when viewed in the context of central planners throwing around stimulus figures in the neighborhood of 5% of a country's total GDP. From Reuters: The Japanese government is planning direct fiscal spending of around 7 trillion yen ($67 billion) to help fund an economic stimulus package totaling more than 28 trillion yen, two people briefed on the matter told Reuters on Thursday. That amount - at just a quarter of the total package - could disappoint some market players bracing for bigger outlays given the massive headline figure, equal to more than 5 percent of gross domestic product.

High levels of debt, tepid global growth, and hyper-dovish central bank policies have helped push a somewhat odd trio of ETFs to new highs, as outlined on July 22. |