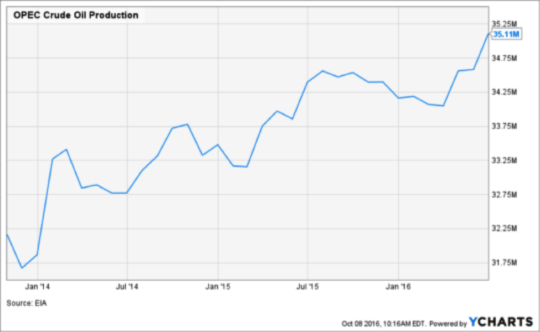

This post $50 Oil Is Back ? Here Is What You Should Know appeared first on Daily Reckoning. Surging American shale oil production might have been the catalyst that started the fall in the price of oil back in July 2014, but an overabundance of OPEC production kept the slide in prices going. The Saudis didn't just leave production as-is, they actually cranked production up into an already oversupplied market. You can see the increase in the chart below.

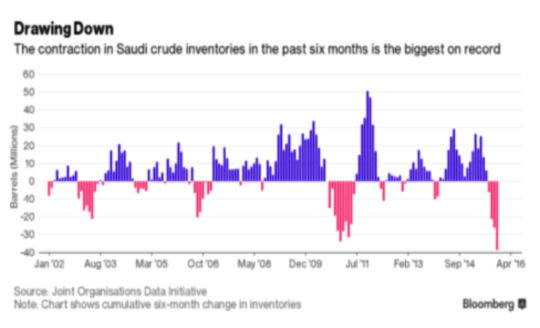

Saudi Arabia raised production, Iraq continued growing and the sanctions on Iran ended. All of this pushed total OPEC production up 3 million barrels per day from the start of 2014. That right there is the reason that this oil crash has lasted so long. If the desired effect was to slow U.S. shale production growth it has certainly worked. U.S. production is down a million barrels per day from the recent peak in April 2015.1 If you consider that US production was growing at a rate of a million barrels per day each year prior to the crash, then this one million barrel per day decline means that OPEC has had a huge impact. But it hasn't been pain free for the OPEC nations either. Saudi foreign reserves have dropped from $737 billion in August 2014 to $555 billion today as lower oil revenues caused significant deficits. That is a massive amount of money gone in a very short time frame. That kind of cash burn can't go on very long which is likely why we are now seeing a change in Saudi/OPEC strategy. On September 28, OPEC announced that it has had enough and that it has for the first time in eight years agreed on a production cut. The group's intention is to decrease production by approximately 750,000 barrels per day. A decrease of that size is enough to make a big difference to the oil markets. The price of oil responded to this announcement with WTI oil moving from $45 per barrel to $50 within a few trading days. There is plenty of doubt in the market about whether OPEC will actually follow through and reduce production. The jawboning alone has provided the initial oil price support. I can't speak for what OPEC/Saudi Arabia will do (obviously), but I would note that the last time they announced a cut at the tail end of 2008 they did follow through with action. When that cut was announced oil was in the thirties and within a year it had more than doubled as OPEC removed production from the market. We will have to wait and see what happens this time, but it does look like we just experienced a major moment in the oil markets. There has also been some good news for oil bulls here at home as well. Oil Inventories Are Tightening, Too? Finally, oil inventory levels in the United States have provided some support for oil prices. In the month of September U.S. oil inventories experienced the largest decline for that month since 1920. There is still a long way to go to get those inventory balances down to a normal level, but it is a start. U.S. inventories finally starting to decline follows a trend we had already seen in Saudi Arabia and with Iranian floating storage.

Source: Bloomberg Inventory movements are the best single indicator of daily oil supply and demand fundamentals so any positive trend would be very important. Another thing to keep our eyes on in the weeks and months ahead. With this OPEC announcement and oil inventory levels dropping globally the worst does seem to have finally passed for the price of oil and companies directly exposed to it. It's looking like better days for the price of oil lie ahead. Keep looking through the windshield, Jody Chudley

for The Daily Reckoning Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post $50 Oil Is Back ? Here Is What You Should Know appeared first on Daily Reckoning.  |