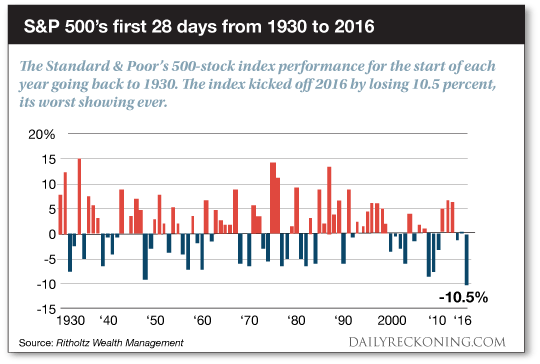

This post They're Writing Trump's Obituary appeared first on Daily Reckoning. The smoke has cleared. After last week's volatility shock, stocks are settling back into their boring routine. The major averages absorbed Wednesday's gut punch like champions. Despite the Dow's 375-point swoon, the Big Board finished the week down a little less than half a percent. But that hasn't stopped the media from furiously writing the Trump administration's obituary. While the market noise has quieted, the political shrieking is getting louder. It's easy to get caught up in the speculation. But you must remember? We don't have a crystal ball. We don't know if stocks will finish up or down in 2017. We don't know which commodities will rise and which ones will fall. We don't know for sure how political events will shape the market. No one does. But we don't need to make any bold forecasts to make money in the markets. Of course, not everyone agrees with this idea. I'm apparently one of the only people in the universe who hasn't carved the market's full-year performance in stone. We were forced to endure endless ?Dow 20,000? headlines during the first few months of the year. Now the political pundits have hijacked the tape. They tell us what will happen if Trump starts more trouble ? and how many points the market will rally (or fall) if he's forced out of office. Everyone from the big bank analysts to lowly bloggers is taking a stab at what the White House will unleash on unsuspecting investors. Yet no matter how much data they use to back up their claims, even the best predictions are nothing but empty guesses. And we don't have to dig very deep to prove it? Just one short year ago, stocks suffered their worst start in history. The major averages rang in 2016 with a thud. After the first week of trade, only about 25% of stocks in the S&P remained above their respective 200-day moving averages. Market breadth was downright awful. Cracks appeared in several vulnerable sectors. Meanwhile, transports and small-caps were quickly entering bonafide bear markets. The S&P finished the first month of the year down a cool 5%. That was the worst January in seven years. That's right?the S&P 500 hadn't dropped that much in January since 2009. It was all too easy to get caught up in the carnage. Prophesizing a major market meltdown in January 2016 wasn't crazy talk. From the average investor to the smart-money portfolio manager, the world's markets looked like they were ready to come crashing down. Of course, we now know how these doomsday scenarios played out. After dropping double-digits to start the year, stocks came roaring back to life.

Ultimately, the long-term investors who panicked early last year were forced to watch stocks rip off their lows. The S&P 500 finished the year with 10% gain. But the hardest-hit groups were the real champions of 2016. Those pesky small-caps stormed back to post gains of more than 40% off their February lows. The SPDR S&P Biotech ETF jumped nearly 30%. Emerging markets collectively rose 23%. Did I see any of these incredible moves coming as despair set in during the first weeks of 2016? Nope. I don't know what's in store for the markets for the rest of 2017. No one does. But I do know we'll be able to book gains by shutting out the noise and following the market's most powerful trends. Book it? Sincerely, Greg Guenthner

for The Daily Reckoning The post They're Writing Trump's Obituary appeared first on Daily Reckoning.  |