This post Here's the Biggest Breakout of the Summer? appeared first on Daily Reckoning. The market is shooting higher to start the new trading week. The major averages ripped to new highs yesterday. Dip buyers are already stepping in to play the weakness in the big tech stocks. Meanwhile, the Nasdaq Composite obliterated every single cent of last week's losses during Monday's session. The tech bears are retreating? for now. For the first week of summer, stocks are getting pretty darn exciting. A slew of market-moving news is hitting Wall Street right now. Summer doldrums be damned! Today, we're going to take a look at three of the most important stock market stories that are developing this week. One them is even pointing to a powerful new breakout. Let's dive right in? 1. Amazon continues its quest for world domination?The news that Amazon was set to buy Whole Foods for nearly $14 billion knocked the wind out of every market-watcher on the planet on Friday… Amazon is on top of the world right now ? and the Whole Foods deal gives one more big reason for Wall Street to sing the company's praises. We all know how Amazon has decimated the retail sector (the carnage just keeps getting worse, with major retailers dropping like flies with every new earnings miss). But now the king of e-commerce is ready to take on the grocery world ? one of the few corners of the old retail model that seemed to have a chance at defending its turf.

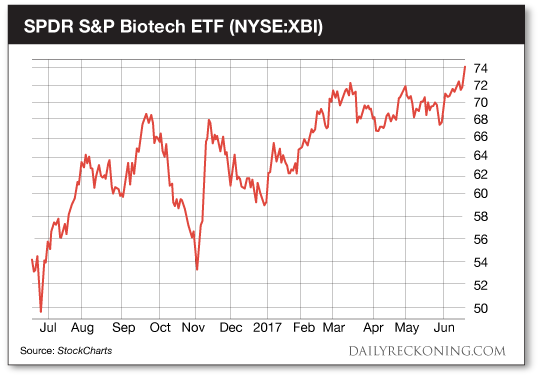

Naturally, a handful of grocery stocks cratered when the Amazon-Whole Foods deal hit the wire Friday morning. We haven't seen a floor for the maligned retail sector just yet. Now's not the time to try and catch these falling knives? 2. More Dumb IPOs are on the way!Snap Inc. (NYSE:SNAP) has already helped countless speculators burn their investment dollars this year. But if you haven't lost mountains of money on an overhyped IPO, don't fear ? more are on the way! Blue Apron is expected to go public on the NYSE before the end of the month using the ticker APRN. The company is one of a few prominent ?meal in a box? subscription services that sends subscribers ingredients and recipes for healthy food they can cook from scratch. If all goes as planned, the company will come on the market with a valuation of around $3 billion. If you think a $3 billion valuation is a bit pricey for a company that sends overpriced food and recipes through the mail, you aren't alone. I can't wrap my head around why anyone would want to buy shares of this company right out of the gate. I felt the same way about Snap when it debuted earlier this year. But that didn't stop shares from trading nearly 50% above the initial pricing back in March even as an analyst slapped the stock with a downgrade right out of the gate. A dismal price target of $10 per share didn't deter a single speculator. Snap's first earnings report helped bring the stock back down to earth. After hitting highs near $30 per share just a couple of days after its IPO, the stock has since found lows near $17. Remember, most IPOs are just cash grabs for up-and-coming companies and underwriters ? especially in trendy sectors and industries. Unless you're looking to flush some more money down the toilet, ignore the Blue Apron IPO when it hits the Street later this month? 3. Biotechs are setting up for a breakout. While most investors remain laser-focused on the big tech stocks, the biotech sector is posting a massive breakout. The SPDR S&P Biotech ETF (NYSE:XBI) jump almost 4% yesterday, launching the ETF to levels not seen since late 2015.

The outperformance we're beginning to see in biotechs is telling. Not only have these stocks remained vulnerable to political attack related to the drug pricing scandals that made headlines last year ? they've also had to dig out of a nasty bear market. Remember, even after bouncing off its winter lows, the group underperformed every other major sector on the market in 2016. Last year, the Health Care Select Sector SPDR (NYSE:XLV) had registered its first annual loss since 2008. Now it's bouncing back in a big way. That's great news for the sector. This move could very well develop into the biggest breakout of the summer? Sincerely, Greg Guenthner

for The Daily Reckoning The post Here's the Biggest Breakout of the Summer? appeared first on Daily Reckoning.  |