This post Flash Crash Alert: Klarman Weighs In On High Frequency Trading appeared first on Daily Reckoning.  Buckle up folks! Buckle up folks!

Baupost Group's Seth Klarman just issued a warning, and it would be a BIG mistake to ignore it. Klarman believes we are headed for a stock market event that will knock your socks off. And you won't even see it coming, as it will be over in the blink of an eye. Don't panic though. After reading this, you'll be more than prepared. And you may even profit? You'll likely be surprised to learn that today, that we have a higher percentage of computer-generated trades than trades that are made by humans like you and I. And what's even more surprising is how much higher that percentage is? Analysts believe that today, as much as 90 percent of market trades are the result of computer algorithms.1 That means that you and I are not the source of market-changing moves anymore. It's the endless rows of servers who have the control?

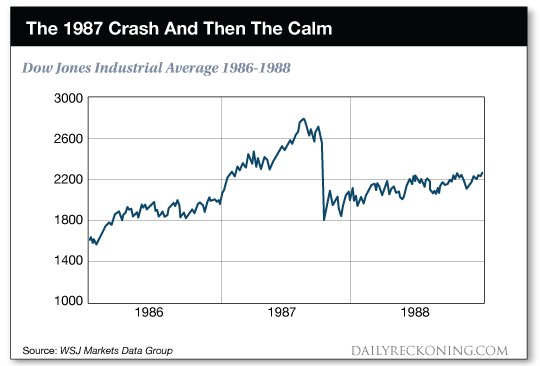

Source: simanaitissays.com Isn't that insane? The purpose of the stock market is to provide a supply of capital for worthy businesses. That is something that all of this non-human trading has nothing to do with? Think about it. 90 percent of transactions in the market involve zero thought given to things like valuation, business prospects, balance sheet leverage, management quality, or essentially anything related to the underlying company. A computer algorithm doesn't care if it is paying two dollars or two trillion dollars for the shares of any given company. There is literally no application of common sense. This type of trading is exactly what Seth Klarman's warning to investors talks about - the time bomb that algorithmic trading funds are building in our stock market. The problem, according to Klarman, is that the main mathematical formula behind many of the algorithmic trading patterns is exactly the same - the formula involves using volatility as the trigger that determines how much risk to take on.2 When volatility is low, the computers get more aggressive. When volatility is high, the computers back off. But it gets worse? When market volatility decreases, these computers are not just buying stocks outright. They use debt to increase their buying power. Basically adding fuel to the fire? And as you are likely aware, volatility has been low for a long time, which has given the computers the message to buy, buy, buy ? while using debt to do so. So what happens if volatility rises? Computers Have No Regard For Your RetirementUnfortunately, the same thing will happen in the other direction. Only much, much faster. All it's going to take to start the elevator ride down is one little spike in volatility. Maybe a geopolitical event causes this, maybe an unexpected rate hike does the trick. I don't know specifically what it will be, but it will happen eventually. A computer can't tell if the actual event is important - it will only care about the increase in volatility. But you need to be aware, we don't need a huge spike in volatility. Volatility just needs to move towards historically normal levels from the current incredibly low levels. When that happens, it will trigger the deleveraging bell for the computers. The algorithmic programs will all begin selling at the same time, which will snowball into even more selling. All of a sudden, we'll have a self-fulfilling selling loop that is going to feed on itself. Anything can happen. No price is impossible for a trading algorithm that can't tell the difference between a business that gushes cash and one that is on the verge of bankruptcy. Once the algorithmic selling starts, investors who have been pouring hundreds of billions into index funds are going to panic and start selling too. It is going to be spectacularly terrifying. But there will be opportunities? The Washout Will Be Devastating, The Opportunities Created Will Be WonderfulTwenty-five years ago we got a taste of what can happen when the robots take over the market. Over the five days beginning on October 14, 1987, the Dow Jones lost 31 percent of its value. 23 percent in a single day. Can you imagine how it feels to see the entire market lose a quarter of its value in one trading session? And then just as quickly as the crash arrived, it ended. Things went back to normal and the market gradually recovered.

That's what widespread systemic trading can do. It can create selling upon selling upon selling. In 1987, the cause was trading systems that utilized the concept of ?portfolio insurance?. If you looked at the chart of the stock market in 1987, you would think that the United States had been attacked, that the banking system had collapsed, or that some other terrible event had occurred. But that wasn't the case. The robots all just changed direction at the same time. Today, 90 percent of our stock market trades are done by machines. Just imagine what could happen next time the robots change direction. The 1987 drop may look like a gentle decline. Baupost has been building up a large cash position so that it can pick up the bargains that the frantically deleveraging robots create. You may want to consider doing the same. Here's to looking through the windshield,

Jody Chudley,

Chief Credit Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com

Facebook: @TheDailyEdgeUSA 1 Rise of the billionaire robots: how algorithms have redefined hedge funds, The Guardian, Suzanne McGee

2 Baupost Readies Dry Power Amid Frothy Markets ? Letter, ValueWalk, Mark Melin The post Flash Crash Alert: Klarman Weighs In On High Frequency Trading appeared first on Daily Reckoning.  |