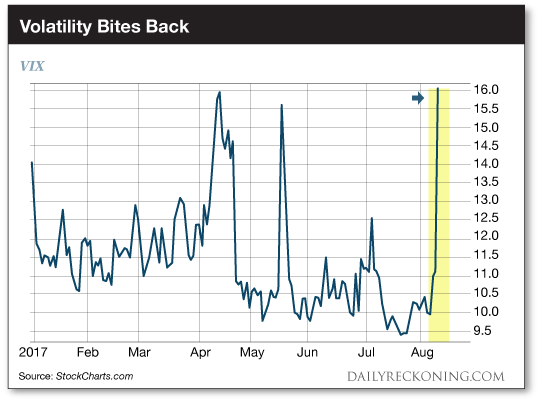

This post Stock Market Smackdown: Volatility Roars Back! appeared first on Daily Reckoning. The stock market's smooth summer ride is over. Just last week, we said everyone was getting a little too giddy about the bull market. Trump's Dow 22,000 party was a little too much for the overextended major averages to handle. You know the drill. The market always finds a way to punch you in the gut whenever you start to get cocky after booking an impressive string of winners. Let's dive right into the carnage? The Dow slipped more than 200 points to close well below 22,000. The red-hot Nasdaq Composite fell more than 2%. Meanwhile the S&P 500 endured a drop of 1.45%. That's its biggest one-day drop since May ? and just the third time this year the S&P has lost more than 1% in a single trading day. I honestly did not believe Thursday was just the third day in 2017 that produced a drop of more than 1%. I double-checked my numbers and even emailed a friend to make sure I hadn't lost my marbles. But it's true. I'm flabbergasted. The market's calm rise this summer has been surreal. I noted last week that a 5% pullback would scare plenty of weak hands out of stocks and provide the perfect setup for a fourth-quarter rally. We're well on our way to pullback status after yesterday's swoon. Remember, most investors have forgotten what a pullback even feels like. Even a mild correction could induce some serious short-term panic. I suspect this quiet market has lulled many investors to sleep over the past few months. Yesterday's action should serve as a wake-up call to anyone who expected trading would remain easy forever. Of course, yesterday's drop also means volatility roared back to life. The VIX spiked nearly 45%, its biggest single-day jump since May. It now rests near its year-to-date highs.

Back in April, the VIX suffered its worst drop since 2011. It continued to explore lower ground in July. Market action had basically flat lined ?until yesterday. Yes, investors have enjoyed record low volatility so far in 2017. But those who were stuck shorting volatility for ?easy money? took their lumps. Since stocks hadn't seen a meaningful drop in months, yesterday's freefall felt much worse than it was. Bottom line: The S&P 500 hasn't posted a 5% pullback in more than a year. We're long overdue for some meaningful downside action. Right now, we're seeing a perfect scenario shaping up to deliver lower prices over the next several weeks. August is usually a difficult month for the markets. Ditto September. These are traditionally volatile weeks leading up to the beginning of the strongest six months of the year for stocks that usually begins sometime in November. Also, the media is in full war-mongering mode. All the serious journalists are practically begging for North Korea and the U.S. to start lobbing missiles. Every day, they pump stories into our living rooms about nuclear fallout and World War 3. Any investors looking for an excuse to sell will find one. Your best move right now is to sit tight. We've maintained a tight portfolio over the past several weeks. There's no need to rush out and frantically ?buy the dip? just one day after the market's first significant drop in months. Sincerely, Greg Guenthner

for The Daily Reckoning The post Stock Market Smackdown: Volatility Roars Back! appeared first on Daily Reckoning.  |