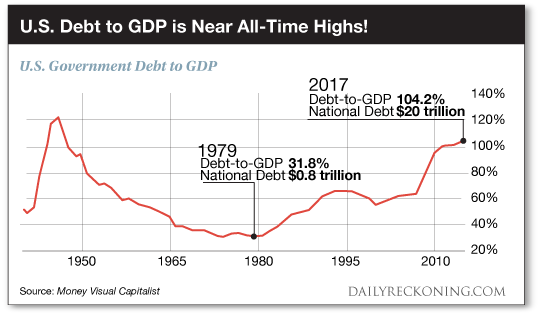

This post If you're 53 to 71 years old? *New Retirement Warning* appeared first on Daily Reckoning. Well this is concerning. According to a survey conducted by Legg Mason, American baby boomers on average are in terrible shape when it comes to savings for retirement. These poor folks are woefully underfunded. To be clear, Legg Mason defines a baby boomers are being between the age of 53 and 71. For most of these people, the time to accumulate a retirement savings is in the rear-view mirror. This isn't a distant problem. This is a five alarm fire right now. On average these baby boomers have $263,000 saved in their defined contribution plans. That figure is $395,000 less than the $658,000 these people believe they actually need. This 53 to 71 year old group has saved less than half of what they need. Obviously they should be very concerned. And the rest of us should be concerned as well. These baby boomers represent 76 million people that are on average $395,000 short in their retirement savings. That is a $30 trillion hole that somehow needs to be filled. Worse still, it needs to be filled soon… Central Bank Intervention Is To BlameHow did we get here? How did so many people end up with less than half of the money that they need in their retirement plan? The problem is two-pronged - both of which can be traced back to central banking intervention. For most of these baby-boomers, the last 20 years should have been the time when their retirement accounts climbed at a rapid pace. These were peak earning years for these folks and the large balances in the accounts should have compounded quickly with anything close to decent investment results. Therein lies the problem. These people haven't had anything close to decent investment results. In response to the tech bubble crash in 2000, the Federal Reserve dramatically cut interest rates in an effort to spur the economy ? practically kicking the can down the road. What those low rates created over the next several years was the building of an outrageous housing bubble in the United States. One that the Federal Reserve somehow couldn't see. We all know how that ended - a market collapse for the ages. The worst in a generation. That was Central Bank Created Problem #1 for baby-boomers. That market collapse crushed their retirement accounts at a frightening time as they approached retirement. In response to this, many baby boomers have forever abandoned the stock market. That has been a huge blow to their retirement accounts which as a result have not earned anything close to the returns that were needed to build sufficient retirement wealth. Which brings us to Central Bank Created Problem #2 for baby-boomers… Since some boomers weren't invested in stocks, they had no chance of earning anything on their savings. After all, Central Banks have kept rates close to zero for some time now… So instead of compounding their retirement portfolio at rates of nine or ten percent, they have been receiving a pittance of interest income thanks to absurdly low interest rates. And now they have run out of time… What Is Going To Happen?I know that Janet Yellen has told us that there will never be another financial crisis in our lifetime. But call me crazy, I'm concerned with the $30 trillion hole in the retirement accounts of 76 million baby boomers. That is an absurdly large amount of money. Who is going to plug this hole for us? Does it fall to the U.S. taxpayer? The U.S. Government balance sheet certainly doesn't have room for it. We already stretched that thing to the max in the bail out from the Great Recession and the years of Federal Reserve asset purchases that followed. For some perspective take a look at how the U.S. debt to GDP looks right now in the chart below.

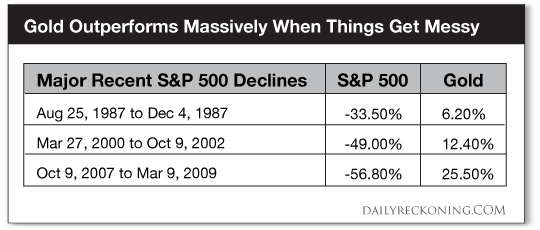

Forty years ago, the U.S. had $0.8 trillion in debt and a Debt-to-GDP ratio of 31.8%. Today, we are at $20 trillion of debt and a Debt-to-GDP ratio of 104.2%. On top of that precarious position, the Government also has a multi-trillion dollar Social Security funding gap to somehow make go away. Now, I can see that the equity markets are not the least bit concerned about this today. And hey, it could be a few years before this really hits the fan. But eventually, someone is going to have to cover this $30 trillion hole… Here Is Your Port In The StormI'm not a doom and gloom guy. I think over the very long term American stocks are going to be a great place to have a significant chunk of my net worth allocated to. However, I also like to sleep at night. Every night, including when we go into one of those financial crises that Janet Yellen believes have gone the way of the dinosaur. Before the next one of those comes, I'd encourage you to take a look at the chart below. It depicts what gold has done during the last three major S&P 500 collapses.

One of those columns could be your key to a restful sleep in the middle of a storm. Nobody cares about gold when stocks go up year after year. But everyone wishes that they had some when the stock market goes for a tumble. I recommend getting in before it's too late? Here's to growing and protecting your wealth!

Jody Chudley

Chief Credit Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com Facebook: @TheDailyEdgeUSA The post If you're 53 to 71 years old? *New Retirement Warning* appeared first on Daily Reckoning.  |