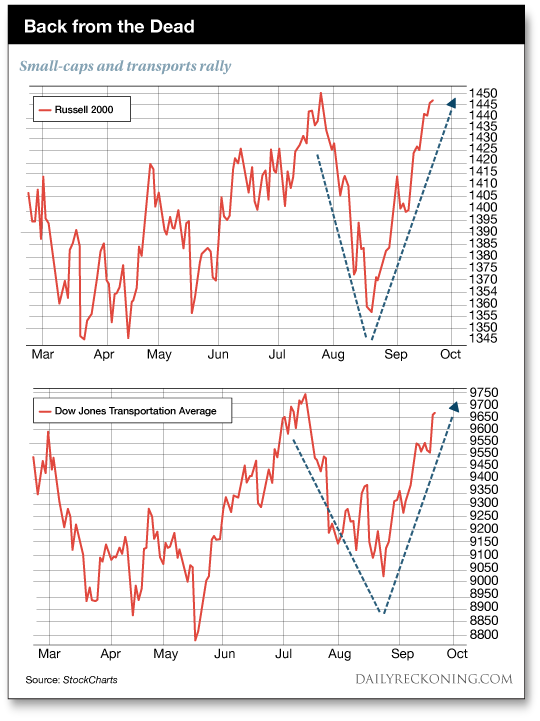

This post These ?Flying-V? Formations Ignite an Early Melt-up appeared first on Daily Reckoning. We were supposed to see a September pullback. Exactly one month ago, we highlighted two major market weak spots that were starting to weigh on stocks: Small-caps and transportation stocks were quickly breaking down below key levels? The charts were grim. On July 25th, the small-cap Russell 2000 launched to new all-time highs. It looked like small stocks were ready to soar after consolidating for most of the summer. But the move didn't stick. By August, the Russell looked awful. It smashed below its 200-day moving average for the first time since its November rally. Less than one month after clocking new all-time highs, small-caps were breaking down. It dropped 6.5% from its all-time highs in a matter of weeks. That's not exactly bullish. The bad news didn't stop there. Transportation stocks didn't look much better than the flailing small-caps. Like the Russell, the Dow Jones Transportation Average broke out to new all-time highs in July. And like small-caps, transportation stocks immediately lost their momentum after breaking out. Just as the Russell was breaking down, the transports closed below their 200-day moving average, sinking to lows we hadn't seen since late May. That was almost 7% below its July highs. Plenty of traders (including us here at Rude HQ) were concerned about small-caps and transports breaking down. After all, these two groups tend to lead broad market action. A sudden drop in these risk-on sectors can precede a bigger pullback in the major averages. But we have to remember what the great Jesse Livermore said: The market is designed to fool most of the people most of the time. As luck would have it, last month's breakdowns in small-caps and transports didn't follow through. The bears couldn't push these stocks beyond the brink of disaster. In fact, the fast drops we witnessed actually ignited massive ?flying-V? rallies.

Failed breakouts and breakdowns tend to produce incredibly strong moves in the opposite direction. That's exactly what we've witnessed in small-caps and transportation names over the past four weeks. Admittedly, the small-cap sector has produced one of the most difficult breakouts we've tracked this year. As we explained earlier this week, we endured several pushes toward new highs that have all failed over the past nine months. Last month's quick drop likely shook out most of the weak hands. Could this be the breakout that finally gets legs and extends to sustained new highs? We'll just have to wait and see. More importantly, our two ?flying-V? rallies show us there's a strong bid underpinning this week's market action. Yes, the major averages have showed some weakness following the Fed's announcement to finally begin shrinking its balance sheet. But the Russell 2000 finished Thursday trading near breakeven. Transports posted a small gain. The major averages? They all finished the day in the red. With just a week to go in the third quarter, small-caps and transports are already setting up for a powerful rally. Bottom line: It's been a great year to own stocks. And we could very well see a strong market melt-up in the fourth quarter. Small stocks and transports are already tipping their hands. Don't sleep on these important rallies! Prep for a potential melt-up while you have the chance. The last three months of the year could get very interesting? Sincerely, Greg Guenthner

for The Daily Reckoning The post These ?Flying-V? Formations Ignite an Early Melt-up appeared first on Daily Reckoning.  |