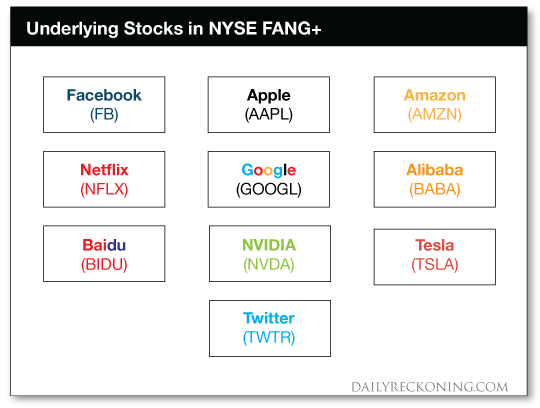

This post JFK Sr. Used This Simple Trick To Spot Market Bubbles? And You Can Too appeared first on Daily Reckoning. They don't ring a bell at the top and tell you to get out, but I have to say that I'm pretty sure that I can hear something. I'm not sounding the alarm on the entire market, but I think it is past the point where buying certain very popular technology companies is a good idea. In fact, I'd go as far as to say that you do not want to own this group of companies today. More on that in a moment. First, let's look back at some helpful history? JFK's Father And The Helpful Shoeshine BoyI mentioned that there isn't anyone who rings a bell for us at the top to tell us that it's time to sell. That isn't fully accurate, because there are always signs. The trouble with those signs is that while they are very obvious with the benefit of hindsight, they aren't so easy to see in real time. In 1929, JFK's father Joseph Kennedy Sr. picked up on one of those subtle signs and didn't just get out at the top, he scored a massive windfall on the way down as well. Like for virtually anyone invested in the stock market, the 1920s were good to Joseph Kennedy Sr. How could they not be, all you had to do was buy all the stock you could and watch it go up. After having made a bundle owning stocks in the roaring bull market of the 1920's, Joe Kennedy Sr. found himself needing to get his shoes polished up. While sitting in the shoeshine chair, Kennedy Sr. was alarmed to have the shoeshine boy gift him with several tips on which stocks he should own - yes, a shoeshine boy playing the stock market. This unsolicited advice resulted in a life-changing moment for Kennedy Sr. who promptly went back to his office and started unloading his stock portfolio. In fact, he didn't just get out of the market, he aggressively shorted it - and got filthy rich because of it during the epic crash that soon followed. They don't ring bells at the top, but apparently when shoeshine boys start giving stock advice it is time to head for the exits. The Shoeshine Boy Moment For FANG And FriendsIn early March 2009, the current bull market began in the same way that most of the great bull runs in history have, at a moment when investors were terrified to own stocks. Since then it has been nothing but good times. We are now eight and a half years into this bull market making it the second longest in history. This party has been fun. And for a handful of the most popular stocks, fun doesn't do it justice. The party has been positively off the chains. The stocks that I'm talking about are the FANG (Facebook, Amazon, Netflix and Google) stocks plus a few of their friends (Tesla, Alibaba and others). These stocks have vastly outperformed the market during this bull-run. Now this is where I become a bit of a party-pooper. Where Joseph Kennedy Sr. had his shoeshine boy moment for the market in 1929, I believe that a similar warning sign arrived for FANG and friends this summer. Remember, they don't ring a bell at the top but there are signs. This I believe is a big one? The demand for these stocks has become so high that specific ETFs and dedicated index funds are being launched that are comprised only of FANG and friends. Not just an ETF or index fund, but multiple versions. That latest is called the NYSE FANG+ index. It includes 10 highly liquid stocks that are considered innovators across tech and internet/media companies. It is marketed as a benchmark of today's tech giants. That may be true, but it is also a benchmark of some of the most expensive stocks in the entire S&P 500. Here are its components:

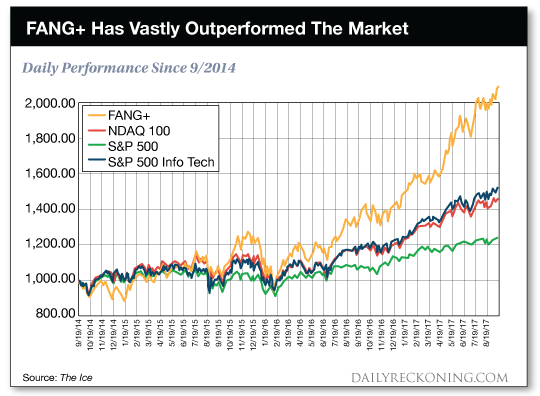

On a backwards looking basis, this group of stocks has performed exceptionally well with a 28.44% annualized return from September 2014 through September 2017.

Yes, I'd love to go back in history and own this group of stocks three years ago. But would I want to own them after an already incredible run? No! As a group these stocks are frighteningly expensive today. That is generally what happens when stocks go up that fast, they become much less attractively valued. Rather than just take my word on that, let's look at some facts. Here are the current trailing price to earnings multiples for each of the members of the NYSE FANG+ index: Facebook ? 37 times Apple ? 17 times Amazon ? 242 times Netflix ? 215 times Google/Alphabet ? 35 times Alibaba ? 62 times Baidu ? 47 times NVIDIA ? 51 times Tesla ? Doesn't even turn a profit Twitter ? Doesn't even turn a profit Individually these stocks range from expensive to absurdly expensive. On average though, I'd have to say the valuation of the group is close to the absurd. The average price to earnings ratio of the eight companies that actually have earnings is 88 times. Yikes! That number would be even higher if I added the market capitalizations of Tesla and Twitter to that while subtracting their losses. Absurd would also be a word to describe the idea that owning an ETF made up exclusively of these companies. Most of these are really good, if not great companies. And a couple of them have yet to even turn a profit, so the verdict is still out on those. The hard truth is that even really good companies at these kinds of valuations are not good investments. We saw this movie before in early 2000 when companies like Microsoft, Lucent, Cisco, Intel, and Oracle had a combined price to earnings ratio of 58 and lost investors gobs of money when the tech bubble collapsed.1 Shocking even to me is that the Fang+ at 88 times earnings is even more expensive today than that group of tech stocks were at the peak of the bubble in early 2000. Are you starting to hear something that sounds like a ringing bell too? Keep looking through the windshield,

Jody Chudley

Credit analyst, The Daily Edge

Facebook ? Email 1 Apple, Facebook and other big tech stocks tank, weigh on Wall Street, CNBC, Patti Domm The post JFK Sr. Used This Simple Trick To Spot Market Bubbles? And You Can Too appeared first on Daily Reckoning.  |