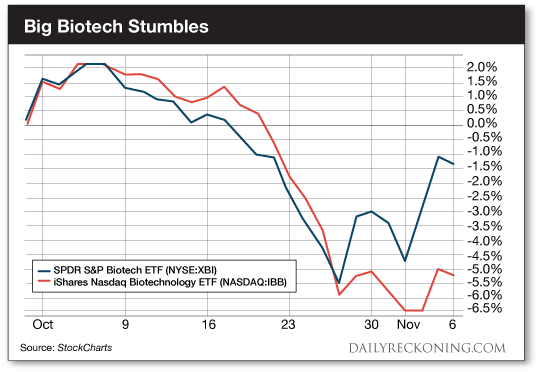

This post How to Survive a Biotech Blowup appeared first on Daily Reckoning. Big biotech stocks were primed and ready to rip higher at the beginning of the fourth quarter. Let me set the scene for you? Smaller biotech stocks were already popping left and right. Throughout late September, small-cap and microcap biotech stocks stole the show. The market was spitting out huge winners almost every single day. As these smaller stocks overextended their gains, we turned to their bigger cousins to keep the biotech bull alive. That's when the market threw a wrench in our gears. October was not kind to the biggest names in biotech. While smaller, more speculative biotech names consolidated, the big kids fell off a cliff. The biotech slide accelerated midway through the month, with both the large-cap iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) and the smaller SPDR S&P Biotech ETF (NYSE:XBI) slipping more than 5%.

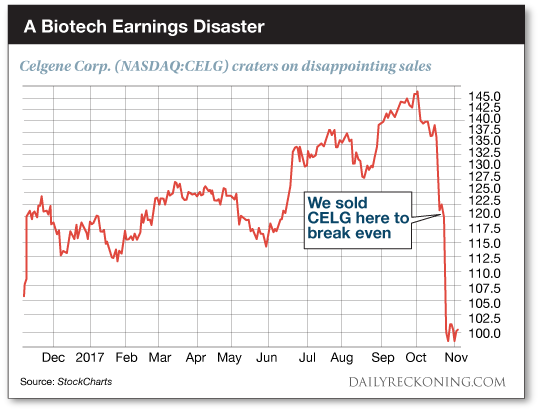

Over the past couple of trading weeks, the smaller biotech ETF has recovered most of its losses. Meanwhile, the iShares Nasdaq Biotechnology EFT still looks heavy. It remains down more than 5% since Oct. 1st. The trouble started when earnings season took a bite out of one of our favorite biotech high-flyers: Celgene Corp. (NASDAQ:CELG). We bought CELG's June dip and rode the trend from $120 to $145. But shares started to look heavy as October trading progressed. We threw in the towel after an abrupt drop pushed the stock back to our entry point. But as it turns out, this slump was only a preview of what was to come. Celgene reported dismal earnings the day after we dumped shares. The company completely whiffed on its sales forecasts and cut revenue outlook through 2020. The news was enough to scare even more investors away from the stock. Shares fell a quick $20 on the day.

The good news is CELG telegraphed its bad news ahead of time, giving us the opportunity to get out of the stock before it could do any significant damage to our trading portfolio. The bad news is the company's disastrous earnings report unleashed a flurry of selling throughout the market's biggest and best-known biotech names. As I noted at the beginning of the quarter, some of the Nasdaq Biotechnology ETF's biggest holdings spent the better part of September consolidating their summer gains. Thankfully, new buyers were already appearing in October helping to snap these stocks back to attention. Major players such as Gilead Sciences (NASDAQ:GILD), Regneron Pharmaceuticals (NASDAQ:REGN), and Amgen Inc. (NASDAQ:AMGN) were bouncing off support and showing signs of life after their third-quarter slumps. Fast forward to November and all these stocks have failed to hold their gains. GILD and AMGN are threatening to retest their respective 200-day moving averages. Meanwhile, REGN has already broken through its 200-day and is now down 25% from its summer highs. Now that the dust has settled, it's clear that sector's biggest stocks aren't yet ready to carry the biotech torch. Instead, the smaller biotech names populating the SPDR S&P Biotech ETF remain our best bet for gains as the market makes its year-end push. Sincerely, Greg Guenthner

for The Daily Reckoning The post How to Survive a Biotech Blowup appeared first on Daily Reckoning.  |