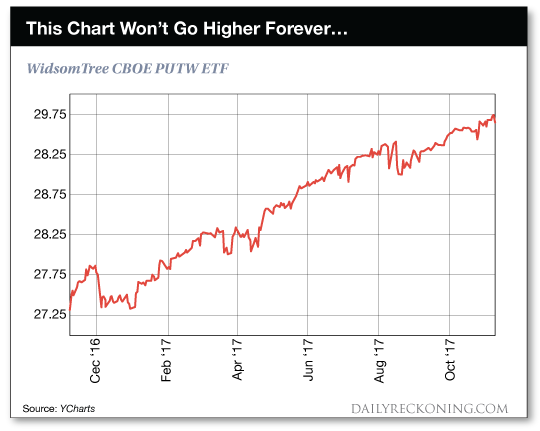

This post Buyer Beware: Instant Income Knockoffs appeared first on Daily Reckoning. I recently got an excited email from a colleague of mine. Matt found a mutual fund that followed a similar strategy to the Income on Demand approach I use with our paid subscribers. "Can I just quit selling puts and invest my money in this fund instead?" Matt asked me point blank. I have to admit, the thought intrigued me at first. But as I looked into the details, I figured out that there were some big problems with this mutual fund. Today, I want to show you what I uncovered, to make sure you don't make the same mistake Matt almost fell into? A Similar ? But Flawed ? Investment StrategyThe fund that my colleague mentioned was the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW). The fund follows an index called the CBOE S&P 500 PutWrite Index (PUT). This index is deceptively similar to the instant income strategy that we use at Income on Demand. But instead of selling put contracts to collect cash payments from individual stocks, the PUT index sells put contracts on the S&P 500. [Editor's Note: If you are unfamiliar with our Income on Demand strategy and the instant income that our subscribers are generating, click here for more information.] Each month, the index sells a number of put contracts on the S&P 500 index. The instant cash from this transaction is collected and invested in Treasury bills to earn a very low rate of interest. At the end of the month, one of two things will happen. If the S&P 500 index is trading above the put strike price, the puts will expire and disappear. This is very similar to how our put contracts for individual stocks expire. This expiration frees up cash for the PUT index to sell more S&P 500 put contracts. On the other hand, if the S&P is trading below the put strike price, the index will have to make a cash payment to cover the difference between the actual price of the S&P 500 and the strike price. This process is very different from our Income on Demand strategy. For our strategy, we sell put contracts on individual stocks, and accept shares of stock that we want to own. But it is impractical for the fund to accept all the stocks in the S&P 500. So a cash payment is made to close out the trade. The fund then sells new put contracts for the next month and starts the process over again. Unfortunately, while this difference may seem subtle, it makes a huge difference for the fund's ultimate returns. Why You Should Avoid This High-Risk FundIn looking at the structure for this put-writing fund, I found two key differences between how the index invests and how we collect our instant income payments. First, our Income on Demand strategy collects instant cash payments from individual stocks while the fund collects payments from a very broad index of stocks. I'd much rather collect payments from individual stocks, because this approach gives us much more control over our income. Each week, I screen thousands of stocks to find our very best Tuesday morning opportunity. In particular, I'm looking for stocks that are very likely to trade higher, have a healthy business (limiting our downside risk) and have options that pay us plenty of cash. By running my screens and being very selective with which stocks we use, I'm able to help you collect the biggest income payments while limiting your risk of stocks pulling back. Unfortunately, the PUT fund strategy is at the mercy of the market. Each month, the fund must sell put contracts on the entire market. It doesn't matter if the puts are cheap (and give only a small amount of income) or if there's a significant amount of risk in the market. Like a robot, this fund will simply follow a blind path and take whatever cash the market is willing to give ? regardless of the risk. The second difference from our Income on Demand strategy is the way our positions are managed. If the market pulls back, the PUT fund must throw in the towel at the end of the month and take whatever losses are currently in play. That's very different from the way I manage our income trades? As you know, when our shares pull back, we automatically buy shares of stock at our agreed-upon price. This goes back to the importance of only picking shares that we want to own. Once we buy shares in our account, we're then able to turn around and collect more income by selling call contracts for these shares. This is a great way to continue to collect income over and over ? until our shares are sold and our position is closed out at a profit. I'd much rather have control ? and an ongoing income stream ? instead of accepting a loss every time the market pulls back. Picking up Nickels in Front of a BulldozerIf you look at a historical chart for the PUTW fund, you'll notice that the fund has been increasing in value since the fund started last year. There have been very few short-term pullbacks.

That's exactly what you want to see in an investment fund, right? Well, not so fast? The fund has been increasing in value simply because the S&P 500 has been steadily advancing. We're currently in a bull trend that has lasted for an excessively long period. It's natural for this fund to make money when the market is moving higher. But let's look a little more closely at the return for this fund. In February 2016, the fund began with a $25 per share price. Today, the fund is trading near $29.44, which is good for a 17.8% gain. That may sound attractive until you see what the S&P 500 index did over that time. During the same period, the S&P 500 rose from 1,917.78 to this week's price near 2,557. That's a 33.3% return over the same time period. So the S&P 500 nearly doubled the put-writing fund's return! Keep in mind this is one of the best-case scenarios for the PUTW fund. We're currently in a market environment that has featured steady advances and very few pullbacks. When the market inevitably pulls back, this fund will likely be crushed! That's because the PUTW fund is still on the hook for nearly the entire loss that the S&P 500 will experience during a pullback. So while the fund made modest gains during a steady market advance, it will experience full losses when the market pulls back. Traders often refer to this type of strategy as "picking up nickels in front of a bulldozer," because you're getting paid a little bit day by day but accepting way too much risk of getting squashed. A more colorful analogy is "eating like a bird and crapping like an elephant." The point is this fund strategy may look attractive on the surface, but don't be fooled. You're much better off using our instant income strategy at Income on Demand to selectively pick the very best income opportunities and to protect your wealth by managing your risk. Here's to growing and protecting your wealth!

Zach Scheidt

Editor, The Daily Edge

Twitter ? Facebook ? Email Now it's YOUR turn to profit from these hidden millions. By generating INSTANT INCOME that can build your wealth faster than you've ever imagined. Sometimes we'll make as little as $185? Other times we'll go for a bigger score of $725. By legally "stealing" hundreds of dollars right out from under the "elites" on Wall Street. >>>Click here for your opportunity<<< The post Buyer Beware: Instant Income Knockoffs appeared first on Daily Reckoning.  |