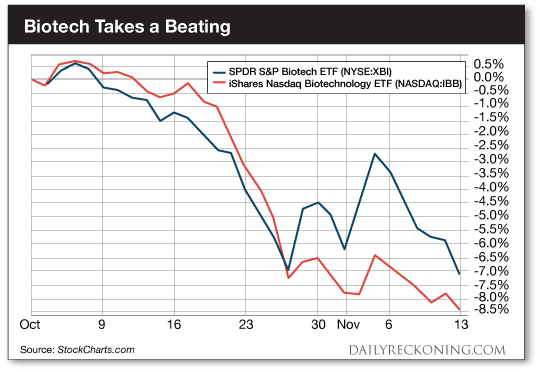

This post Biotech on the Brink! appeared first on Daily Reckoning. Stocks continue to look for direction as we dive headfirst into a new trading week. The S&P 500 gained a measly two points on Monday. The Nasdaq posted a wimpy six-point rise. Earnings season is going out with a whisper as the final trading weeks of 2017 come into view? But if you dig below the major averages, you'll find some important action taking shape in the biotech sector. After sneaking lower to begin the new trading week, the SPDR S&P Biotech ETF (NYSE:XBI) and the iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) are now approaching important support levels. That's right? we're about to see a do-or-die moment for the formerly red-hot biotech trade. Biotech has become a finicky sector since both major ETFs began fading from their highs more than six weeks ago. Large-cap and small-cap biotechs have lost all the positive momentum that propelled these shares to new highs. The small-cap SPDR S&P Biotech ETF is now almost 8% below its early October highs. Meanwhile, the iShares Nasdaq Biotechnology ETF has dropped almost 9% over the same timeframe.

As you've probably guessed, October was not kind to most biotech names. While there are some outliers that have survived this fall pullback, many former high-flyers are coming back to earth. We've talked a lot about major players such as Gilead Sciences (NASDAQ:GILD), Regneron Pharmaceuticals (NASDAQ:REGN), and Amgen Inc. (NASDAQ:AMGN) recently. Initally, these established biotechs were bouncing off support and showing signs of life after their third-quarter slumps. But November has brought more trouble for these stocks. REGN was down 25% from its summer highs when we last updated you on the sector. It continues to push lower this week. Meanwhile, GILD and AMGN are retesting their respective 200-day moving averages. We'll be watching these major players for a potential bounce (or breakdown) in the coming weeks. To be fair, I don't believe a biotech breakdown would spell doom for the stock market rally. While biotech stocks can act as a handy barometer for more speculative trades, the market has already proven it doesn't need full participation from the biotechs to maintain its upward trajectory. Think about it? the household name mega-caps have carried the averages higher all year. Meanwhile, the biotech rallies we've witnessed are more of an under-the-radar market sideshow. But that doesn't mean we don't like trading these stocks when given the opportunity for fast gains. We've had our fair share of big hits, including booking a 25% gain on Bluebird Bio Inc. (NASDAQ:BLUE) earlier this month. As the biotech bull loses steam, we're left with just one trade in the sector: the SPDR S&P Biotech ETF (NYSE:XBI). We've been holding the smaller biotech ETF since early January. It's treated us well and remains up more than 38% year-to-date. Now that it's approaching support, we'll need to keep our finger on the trigger. If XBI fails to hold here, I wouldn't be surprised to see the ETF sink toward its August lows near $75. On the other hand, a bounce near this critical support area could open some new short-term biotech trades for us. The next couple of weeks could set the tone for the entire biotech sector heading into the end of the year. These stocks have the opportunity to catch some fresh momentum and finish the year strong. Or limp into 2018 as an underperforming sector. The clock is ticking? Sincerely, Greg Guenthner

for The Daily Reckoning The post Biotech on the Brink! appeared first on Daily Reckoning.  |