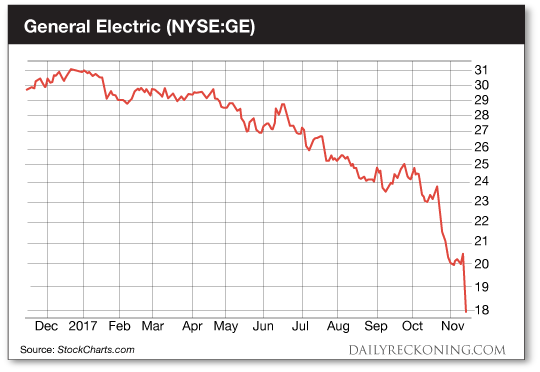

This post Why You Shouldn't Worry About a Correction appeared first on Daily Reckoning. Stocks go down sometimes. I know that's hard to believe, especially in this market. But the major averages will eventually correct. That means some unlucky investors will end up holding more than a few losing positions. But you don't have to deal with the emotional pain caused by the meltdown of one of your investments. If you learn the two simple market truths I'm about to reveal today, you could actually protect your brokerage account from big losses. I'll also show you how use these tips to spot a failing investment before you buy shares. I know how easy it is to get caught up in the story of an exciting company. In fact, nearly every person who has invested a dollar in the stock market has bet on an intriguing story. There are plenty of compelling businesses out there. Unfortunately, a sinking market doesn't care about your favorite stock story. Major market pullbacks don't discriminate. The good stocks move lower with the bad. And losing money on what you thought was a sure thing can be traumatic. You'll find yourself wondering why it all went wrong? It's time to put an end to your uncertainty. You don't need any special knowledge of economics or finance to survive a stock market pullback. In fact, you can apply the tips I'm about to reveal to virtually any investing situation. Here's what you need to know: First, a stock can become ?detached? from the company it represents. What this means is the share price can quickly drop?even if the company in question is releasing favorable news or impressive earnings. A sharp decline in share price on ?good news? is one of the most gut-wrenching situations you'll experience when investing. It's frustrating. And it can cause you to think irrationally. There are countless reasons the stock of a seemingly good company can drop. The company could simply be too early along the development curve to attract more investors. Maybe the investing public has yet to grasp the company's potential. Or maybe a big fund is liquidating its shares. Any of these situations can drive down the share price no matter how good recent news has been for the stock. The truth is, promising companies can have bad weeks or even bad years. You must prepare for this possibility that your idea might not translate to an obvious investment to the average speculator. This brings us to the second market truth you need to remember? Strong selling usually won't abruptly stop and turn into buying. If the market collectively decides to sell a stock for any reason, the selling is likely to continue. Period. I don't care if the stock is selling off due to a rogue analyst chopping the company to bits or a clueless blogger trying to get his name out there by bashing random companies. I know it's tempting to talk yourself into holding a stock that just took a punch to the gut. But nine times out of ten, this is suicidal behavior. Rarely will you see a stock reverse course and move higher immediately following a strong selloff. Investors and traders won't want to buy a stock that's diving headfirst into a strong downtrend because they think they'll be able to get it cheaper if they wait. Think about it. Would you buy a stock that's dropping every single day? Was General Electric (NYSE:GE) a good value after shares had dropped 20% on the year back in September?

The market didn't think so (GE has dropped another 20% over the past two months). When it comes to both situations we've discussed today, it's important to identify when sellers are taking control. If the price starts to move lower on high volume, you must act immediately to preserve your capital. After all, you can always wait and buy shares at a lower price if you still believe in the company. Hey, it's better than going broke chasing a losing stock? Sincerely, Greg Guenthner

for The Daily Reckoning The post Why You Shouldn't Worry About a Correction appeared first on Daily Reckoning.  |