This post Are You Brave Enough to Buy the Dip? appeared first on Daily Reckoning. Investors are losing their minds. Stocks slipped into the red once again yesterday. The Dow coughed up almost 140 points, while the other major averages finished the day down just about half a percent. Overall, it was another uneventful trading day on Wall Street. Just don't try to reason this miniscule drop with your favorite financial news team? As soon as the closing bell sounded, CNBC pounced on the decline. Stocks close at three-week lows! The end is nigh!

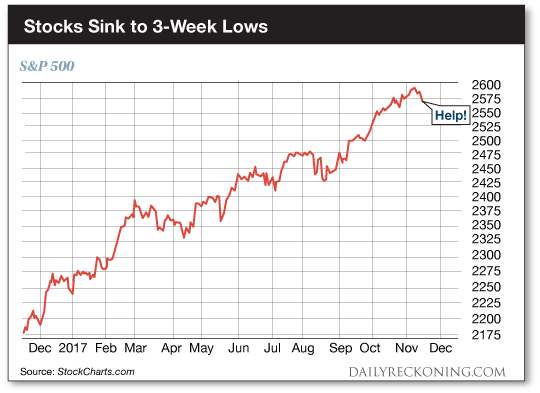

It's true. The S&P 500 is indeed sitting at three-week lows right now. But with the major averages just 1% below all-time highs, the panicked tone of market coverage is bit disturbing these days… Over the past couple of months, the big gripe about the markets has been the lack of dips for investors to buy. How the heck is a trader supposed to ?BTFD? when there are no dips to be found? Stocks have marched higher virtually uninterrupted all year. Anyone patiently waiting for a pullback has remained stuck on the sidelines. But now that we're witnessing what could be the beginning of an actual pullback, investors are cowering in the corner. What gives? Back in the summer, we noted that a 5% pullback from the highs would scare plenty of weak hands out of stocks and provide the perfect setup for a blazing fourth-quarter rally. Even a mild correction could induce some serious short-term panic, we reasoned. But as it turns out, even a 5% drop wasn't a necessary ingredient for the start of our predicted fourth-quarter melt-up. Instead of taking breaks, stocks were breaking records. The S&P 500 has now made it more than a year without a legitimate 5% pullback from its highs. The record run of low volatility we're seeing has made even the smallest moves lower feel like a big deal. Like most investors, the financial media are stirring the pot this week as stocks trickle lower because they've also completely forgotten what an actual pullback looks like. As the market sagged on Wednesday afternoon, we were treated to all types of cautious headlines ranging from bearish Chinese economic data to ?uncertainty? surrounding tax reform. Are these the real reasons why the market is beginning to slip from its highs? I seriously doubt it. Still, we are starting to see little cracks beginning to appear in investor confidence. And the market headlines are looking a lot more cautious. Remember, bad news doesn't matter when the market is screaming higher every single day. But as soon as the tape turns red, the financial media is ready and willing to pounce on any possible explanation for the pause in the relentless market rally. Despite some rotation in more defensive sectors such as utilities and consumer staples, we're not seeing any dire warnings popping up in the market today. Futures are already moving higher this morning, erasing much of yesterday's losses. Anyone panicking at these levels has completely lost touch with the bigger picture. Take another look at today's chart of the S&P 500. The trend is clear. The market is marching higher. Winning trends and consistent trading gains are yours for the taking. Don't get caught up in the insanity? Sincerely, Greg Guenthner

for The Daily Reckoning The post Are You Brave Enough to Buy the Dip? appeared first on Daily Reckoning.  |