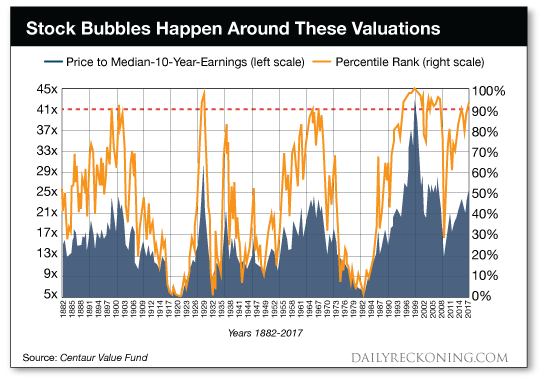

This post New Buy Alert: Better Than Visa appeared first on Daily Reckoning. The stock market is unquestionably expensive right now. Just look at the chart I found in a recent investor letter from the Centaur Value Fund. The chart may look a little busy, but it's actually very simple.

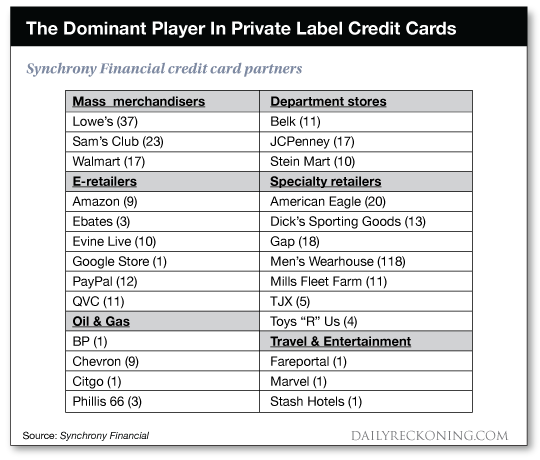

The chart shows us what happens to the U.S stock market every time it reaches the 90th percentile in terms of trailing ten year median price to earnings. Reaching that 90th percentile isn't something that happens very often. The red dotted line in the chart shows you the five prior instances (1902, 1929, 1970, 1999, and 2008). If you are familiar with the history of the stock market, those dates will mean something to you. And the sixth instance is today? The only other five times we hit this kind of valuation it was followed by a pretty brutal stock market collapse. (My portfolio has been through two of them - and they aren't fun.) But while the market as a whole is unquestionably expensive, specific areas of the market are not. The World of SpinoffsSpinoffs are one area of the market that doesn't have overinflated prices. A spinoff takes place when a parent company ?spins off? one distinct subsidiary or business unit into a stand-alone public company. When the spinoff occurs, the shareholders of the parent company receive shares of this newly spun-off entity. The underlying business reason for doing the spin-off is usually to rid the parent of a non-core business so that it can focus on what it does best. What often happens is that the investors who receive the shares of the spun-off business don't want them. Remember, they invested in the parent company, not this smaller subsidiary. Institutional investors in particular aren't interested in owning a much smaller company. The result is that the shares of the spun-off company get sold-off aggressively. Not because of poor business performance, but just as a function of being a spinoff. And any time widespread selling of shares of a company takes place due to something other than underlying business performance, there is potential for opportunity of the observant investor. One fairly recent spin-off that presents opportunity is Synchrony Financial (NYSE:SYF). I found Synchrony in the portfolio of Seth Klarman, perhaps the most respected hedge fund manager of the past thirty years.  Source: Business Insider What made an impression on me with respect to his Synchrony position is that like me, Klarman is extremely bearish on the overall stock market today. In fact, he is so bearish that he currently has 40% of his fund conservatively positioned in cash and recently gave $2 billion back to his investors due to the lack of value plays available.1 Despite his bearish positioning, Klarman has 11% of his invested capital allocated to shares of Synchrony. That is serious conviction. Synchrony was spun out of General Electric two years ago. It is the largest private label credit card provider in the United States - controlling almost half the market. Long story short, it's a dominant, fast growing business that provides credit cards to companies like Amazon, Walmart and PayPal.

This is an excellent business and one that we can buy shares in today at an attractive price. Synchrony currently trades at a price to earnings ratio of just over 14 times. That valuation is a significant discount from the overall market for a company with significantly better growth prospects. With Klarman's blessing and shares now starting to break-out, I believe this is a spin-out worth more than worth checking out. Tune in again next Thursday for another value opportunity straight out of the financial statements of another Wall Street legend like Seth Klarman. Here's to looking through the windshield,

Jody Chudley,

Credit Analyst, The Daily Edge

Facebook ? Email 1 Synchrony Financial (NYSE:SYF), Guru Focus The post New Buy Alert: Better Than Visa appeared first on Daily Reckoning.  |