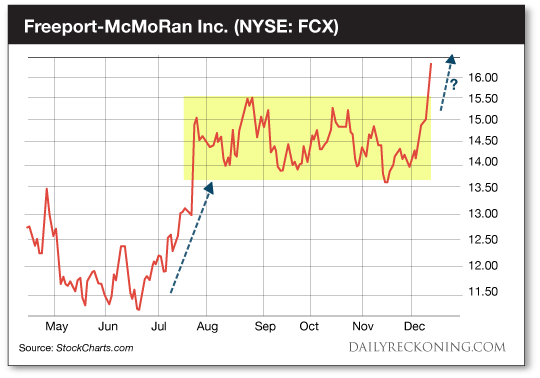

This post Book Double-Digit Gains on This Scorching Metals Breakout appeared first on Daily Reckoning. Bitcoin continues to dominate the financial news cycle. Meanwhile, market rotation continues to quietly disrupt the stock market, helping to push one of your trades to open gains of more than 25%… The Dow Jones Industrial Average is running circles around the S&P 500 and Nasdaq Composite this month. The Big Board was the top performer once again yesterday, sneaking higher by 80 points while the S&P finished the day in the red. Market rotation is helping key industrial stocks launch to new all-time highs while the formerly red-hot tech names remain on pause. Caterpillar (NYSE:CAT) jumped almost 4% yesterday to new all-time highs. The stock has now posted year-to-date gains of more than 65%. This performance is stronger than every single one of the popular FAANG stocks by double-digits? CAT's meteoric rise in 2017 is not without merit. The company has consistently trounced earnings estimates this year, raising earnings guidance and posting strong growth in its construction business. Back in the spring, the perennial loser provided a huge boost to the Dow when its stock soared nearly 8% in just one day. It has now marched higher for nine straight months. Not bad for a stodgy Dow stock no one wanted just a couple of years ago? The global commodity slump that accelerated in 2013 nearly cut CAT stock in half. It's tough to sell heavy equipment and mining machinery while oil is dropping more than 60% from its high and the price of gold and other precious metals slips more than 35%. Now, the rebirth of CAT and the commodity trade is helping stoke the flames of another powerful breakout. After years of pain, we're seeing new life in the copper trade. Copper was, of course, another victim of the great commodity unwind. A lot of folks pointed to copper's reputation as a leading economic barometer since the metal is found in virtually all electronics and countless other industries. But this relationship didn't hold. Copper had drifted lower since 2011 while stocks found new highs. Fast forward to 2017 and we don't see sagging economies in China and Europe weighing on Dr. Copper. In fact, a worldwide economic recovery is now helping to boost materials and mining shares. That's where our own copper comeback play Freeport-McMoRan Inc. (NYSE: FCX) comes into play. You won't hear a lot of talk about copper or FCX in the financial media these days. But if we turn to the charts, it's easy to see Dr. Copper's impressive turnaround move that started to unfold earlier this year. After years of pain and suffering, a sustainable rally is in the works.

FCX first ripped off its lows right after reporting second-quarter profits back over the summer. The company didn't even beat earnings expectations, but solid revenue and upbeat guidance was enough to spike the stock. Shares rocketed by nearly 15% to help push FCX into the low teens. At the time, I said FCX looked to have the potential to scream back toward its February highs above $16. After several months of choppy, sideways action, we're finally witnessing the big breakout we were waiting for? FCX has gained more than $2 per share over the past six trading sessions. The stock has now broken out above its summer highs and appears primed and ready to make a legitimate run to $17 and beyond. I like to say that trading FCX is like buying a call option on copper without the high commission. When this stock breaks out, it can really get going. If momentum traders continue to pile into unloved materials and mining stocks like this one, we could be in for a wild ride. Sincerely, Greg Guenthner

for The Daily Reckoning The post Book Double-Digit Gains on This Scorching Metals Breakout appeared first on Daily Reckoning.  |