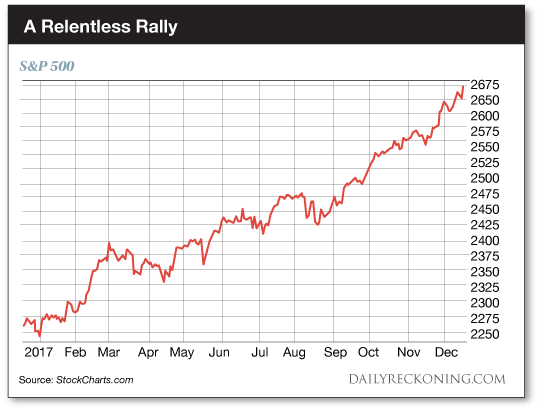

This post What Wall Street Won't Tell You: Expect the Unexpected in 2018 appeared first on Daily Reckoning. Rejoice, investors! Prediction season is upon us! The financial web is now brimming with bold prognostications for stocks, bonds, commodities, and which celebrity is next in line to kick the bucket. Everyone from big bank analysts to lowly bloggers is taking a stab at what 2018 will unleash on unsuspecting investors. But the yearly ritual always ends in disappointing, mundane projections. No one has the guts to stick their neck out and predict a huge move in the markets. Just look at how Wall Street analysts prepped for 2017: Exactly one year ago, the S&P 500 was resting just below 2,300. Trump's unexpected win was still a fresh concern on Wall Street's mind. No one knew what to think about the markets heading into a new year as political ?uncertainty? reared its ugly head. Naturally, all the very serious analysts used political excuses to hedge their bets. Almost no one thought the major averages would gain any traction in 2017. In fact, every single one of the big banks predicted a boring year for stocks. Goldman Sachs, Morgan Stanley, and Bank of America Merrill Lynch analysts set their year-end S&P targets at 2,300. Barclays and JP Morgan prognosticators were a bit more bullish. Both set their S&P 500 targets at 2,400. Prudential employed the only analyst who was hitting the eggnog last December. He posted a 2017 year-end price target of 2,575 for the S&P 500. If this outlier prediction were to come true, it would work out to a gain of more than 10% for the S&P over the next 12 months. Shocking! But investors (and the major averages) had other ideas. Fast forward just one year and the S&P is higher by nearly 20%. The Nasdaq is up more than 27%. And a little-known cryptocurrency called bitcoin is approaching $20,000. Who saw that coming? The S&P eclipsed Wall Street's conservative 2,300 target by early February and never looked back. The index smashed through 2,400 in May. Finally, it tore past 2,575 by the end of October. None of the Street's mundane predictions even came close.

No matter how much data anyone uses to back up their bets for 2018, even the best predictions are nothing but empty guesses. Once again, no one is predicting a big move in stocks ? higher or lower. ?Most of Wall Street's 2018 economic and market forecasts are interchangeable with those from last year,? Barron's notes. ?And the year before that. And the year before that.? But I don't blame these analysts for their wimpy market guesses. After all, every one of them is smarter, better educated, and much more important that I claim to be. They all know how to play the game. In the button-down world of Wall Street, you don't make bold calls. If you want to keep your job, you blend in with the herd. That's not how we roll here at Rude HQ. This week, we're tossing these lame analyst predictions to the curb. Instead of boring you with flat, single-digit S&P predictions, we're slapping you in the face with some of our wildest market guesses for 2018. Stocks. Commodities. Bitcoin. Maybe even a few surprises? Our boldest market calls for 2018 are on the way every day this week. Buckle up. It's gonna be a wild ride? Sincerely, Greg Guenthner

for The Daily Reckoning The post What Wall Street Won't Tell You: Expect the Unexpected in 2018 appeared first on Daily Reckoning.  |