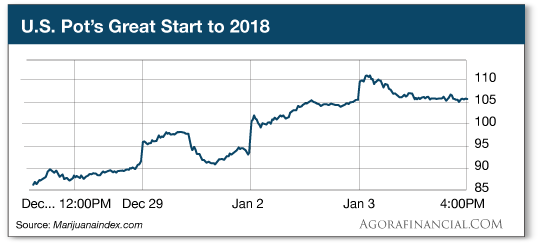

This post POT ALERT ? Buffer Your Gains From the D.C. Swamp appeared first on Daily Reckoning. There's more to come for 2018. Pot stocks enjoyed a nice rally to close out the year. Many of the stocks in the U.S. Marijuana Index charged higher in trading sessions through December. Overall, the U.S. pot index was up 13.15% the first few days of 2018.

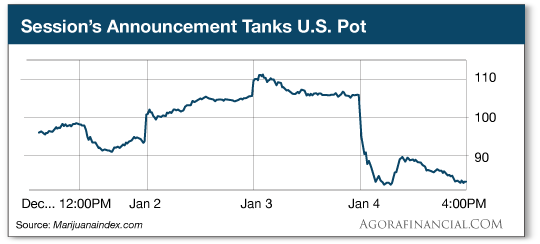

The bull run showed no signs of stopping. Then a bombshell dropped Thursday. The People Have Spoken ? The Government Won't ListenTwenty-nine U.S. states currently have some form of legalized marijuana law on the books. Yesterday, however, U.S. Attorney General Jeff Sessions rolled back major provisions set by the Obama-era ?Cole Memo,? which protected state-level laws on marijuana from federal intervention. The news was a massive blow to the U.S. pot stock market. The U.S. Marijuana Index's value dropped 21.29% as fear of a crackdown ignited a mass sell-off.

Despite the huge drop, it's important we keep all this in scale. For one thing, the majority of these sellers more than likely banked very nice profits. The U.S. index sits exactly where it did on Dec. 27. Meaning that even with Thursday's 21% drop, the index is still up 30% for the past 30 days. It's also important to note that Jeff Sessions did not initiate new enforcement rules or begin a crackdown on U.S. pot. He only rolled back directives from 2013. Weed, as a medical treatment for example, has been legal in California since 1996. Well before Obama sent his ?Cole Memo? out. My suspicion is that the district attorneys will only go after egregious stuff like illegal grow outfits, interstate transportation, sales to minors and so on. A Prudent Strategy for InvestorsCannabis, like any other market, is not without inherent risks. The time I spend on analyzing the pot market is to ensure that I recommend winners with the highest chance for big returns. Regardless of changing sentiment, many investors have reservations about jumping into a market whose products are still deemed illegal at a federal level. That's why today, in wake of the news, I want to introduce you to a brand-new way you can tap into the massive pot profits. Last week, the first world's first marijuana ETF, the ETFMG Alternative Harvest ETF (NYSE: MJX), went live. The MJX offers the more cautious pot investor a great way to start off in the pot market. Since going live the MJX has seen sweeping gains and is up 10% over its first week. Unlike the U.S. pot index, the MJX saw minimal reaction to Sessions' announcement.

The reason? The spread of holdings in the MJX keeps investors buffered from U.S. policy decisions. According to ETF.com: MJX is the first pot-focused ETF in the U.S. The fund tracks an index of stocks across the globe that are engaged in the legal cultivation, production, marketing or distribution of cannabis products for either medical or nonmedical purposes? At the time of launch, the fund did not include companies that grow or distribute marijuana in the U.S. In fact, MJX shows only 8% of the fund invested in U.S.-based companies at all. This means if a federal government decides to intervene directly, 92% of your investment is still safe. It's a high-growth fund, well diversified and moving higher as we speak. If you're looking to get your feet wet with pot, this is a great way to go for steady gains that the D.C. swamp can't touch. Especially in wake of yesterday's news. For Tomorrow's Trends Today,

Ray Blanco Editor's note: We love getting your feedback. Do you expect a pending crackdown on U.S. pot or is this more smoke and mirrors? What have you done with your stakes in U.S. pot? Are you cashing out or holding? Send your feedback to TomorrowsTrendsFeedback@agorafinancial.com. The post POT ALERT ? Buffer Your Gains From the D.C. Swamp appeared first on Daily Reckoning.  |