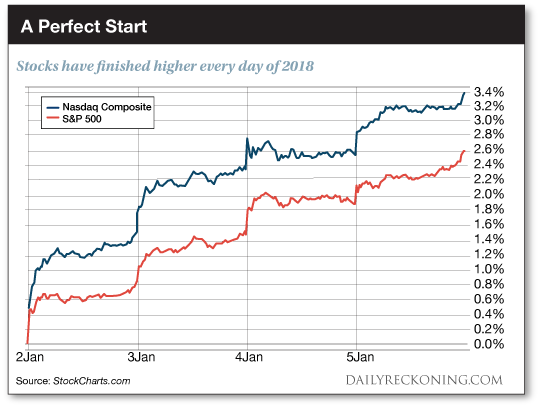

This post Stocks on Steroids: Is it Time to Prep for a Pullback? appeared first on Daily Reckoning. The market's just four trading days into 2018 and we're already witnessing some downright crazy action? The major averages have posted a perfect record so far this year. The S&P 500 is up 2.6% after 2018's opening week. The tech-heavy Nasdaq is up almost 3.4%. Meanwhile, cryptocurrencies continue to go berserk. Dogecoin, an ?altcoin? that was named after an internet meme, just saw its market cap jump above $2 billion for the first time. That's right ? a crypto that began as a joke is now worth almost twice as much as J.C. Penney.

I made some wild guesses about what the market had in store for investors this year. In my series of market forecasts last month, I detailed how I thought the stock market would go ballistic in 2018 rather than posting an ?average? year. You'll probably recall that Wall Street analysts have already said they believe 2018 will be a decent year for equities. Most of these predictions expect the S&P to finish between 5% - 8% higher this year. But I didn't see a boring year shaping up for the averages. There was too much hot action frothing up in the markets, from stories of teenage bitcoin millionaires and the potential for a massive market-boosting tax bill blasting on the TV. The investing class is nearly one decade removed from the financial crisis and the generational market crash it unleashed on the world. Now we're witnessing the bull market buy-in. Instead of doubting every rally, folks are beginning to embrace the markets. Five years ago, cautious headlines warning of a potential double-dip market slump were dominating the news cycle. Every investor was waiting for the other shoe to drop. But worries about risk are evaporating. After all, we just witnessed the S&P 500 march higher by 20% virtually uninterrupted. Who in their right mind would waste time worrying about a meaningful drop? That's the important stuff we need to talk about. Yes, I believe it's possible that stocks finish much higher this year. But this prediction comes with a major caveat: Along with these incredible gains, the major averages will experience at least two pullbacks of 5% or more. In fact, a 10% correction wouldn't surprise me at all. Of course, the major averages dropping double-digits would send many investors into shock. If the market took a quick dive, we would see plenty of short-term panic and top-calling. The record run of low volatility we've enjoyed has made even the smallest moves lower feel like a big deal. Investors have completely forgotten how an actual pullback feels. The market is enjoying one of its least-volatile stints ever. This little tidbit is parroted all over the financial media. But the true extent of this ideal melt-up won't hit home until you dig into the numbers. As of late last week, the major averages are enjoying their third-longest streak without experiencing a 5% drawdown since 1930, Goldman Sachs notes. But it gets even crazier? The S&P 500 hasn't even posted a 3% decline since November 2016, according to MarketWatch. That's its longest stretch ever without a mundane 3% dip. Think about it: The S&P hasn't even dropped three measly percent from its highs since the 2016 election. That's insane! So how soon could a pullback shock the market? It's impossible to say. What we do know is that when it happens, no one will be ready for it. Investors talk a big game about ?buying the dip?. But when an actual dip-buying opportunity presents itself, many of these tough traders won't pull the trigger. One of this year's pullbacks will offer alert traders a tremendous opportunity while everyone else is running for cover. That's why it's so important to plant the idea in our heads now. Anything can happen in the markets. As long as we stay vigilant, we'll continue to rake in consistent gains. Sincerely, Greg Guenthner

for The Daily Reckoning The post Stocks on Steroids: Is it Time to Prep for a Pullback? appeared first on Daily Reckoning.  |