This post How the Ride the Bucking Biotech Bull appeared first on Daily Reckoning. The stock market dropped yesterday ? finally. For the first time in 2018, the major averages dipped into the red to close out a quiet trading session. I know it sounds ridiculous, but some traders are annoyed that the market broke its streak and finished lower. While I don't think I need to write this, I will anyway: the stock market must go down sometimes. Some people are forgetting this inconvenient truth as the trading environment gets a little frothy. Honestly, I'd be worried sick if the major averages shot up for a month straight. That kind of action is much more dangerous than the slow and steady melt-up we've experienced since last year. With the market streaking higher every week, it's tempting to tune out boring down days like we saw yesterday. Don't fall into this trap! When the market slips, you should pay close attention. The action can reveal important clues about where you should look for your next trade. It all boils down to performance. On a down day in a strong market, we need to watch for the stocks or sectors that are outperforming everything else. Sometimes, these will be the stocks that are down less than the averages. Other times, these are stocks that finish well in the green. That brings us to yesterday's action? In a sea of red, small-cap biotech stocks stood strong during Wednesday's trading session. The SPDR S&P Biotech ETF (NYSE:XBI) finished the day higher by more than 1.25% while the Nasdaq Composite was stuck in the red. XBI's comeback rally that began to materialize just before Christmas is now threatening to break out to new highs.

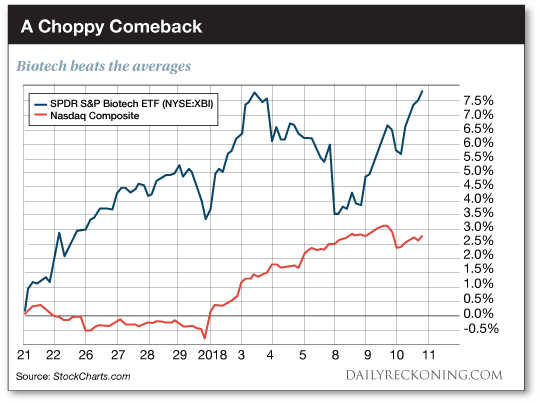

Since December 21, XBI has posted a gain of almost 8%, compared to a gain of just 2.8% for the Nasdaq Composite. We told you last week that the biotech rally wasn't over just yet. In fact, a breakout to new highs within the next couple of weeks could cement these stocks as some of the year's most explosive market leaders. It hasn't been an easy ride during 2018's first two weeks of trading. In fact, it's impossible to miss XBI's whipsaw move in today's chart. After kicking off the year with a two-day gain of more than 4%, the small-cap biotech ETF suddenly reversed and gave back its early gains. It didn't find its footing again until Tuesday. Now, another powerful two-day rally has repaired the damage and set us up for more gains. We noted during the fourth quarter skid that biotech stocks probably needed some time to reset. We weren't totally bailing on the sector. In fact, the large-cap iShares Nasdaq Biotechnology ETF even managed to hold above its 200-day moving average, leaving the door wide open for a return to form if any buyers showed up. But even with this early January comeback in the books, biotechs never make it easy for traders. No matter what, we're probably in for a bumpy ride. Sincerely, Greg Guenthner

for The Daily Reckoning The post How the Ride the Bucking Biotech Bull appeared first on Daily Reckoning.  |