This post The Retail Comeback is Real: Buy ?Dead Malls? Now appeared first on Daily Reckoning. Barron's kicked off the short trading week with another head-scratcher: This retailer's stock has jumped 10% in 2018 ? and there could be more to come. Retail stock? I doubt it. The article probably tells the story of a cutting-edge startup looking to challenge Amazon in the online retail space. Or a logistics firm helping shops streamline their inventory process using blockchain technology. An actual retailer with physical stores couldn't possibly grab investors' attention in 2018. Or could it? It just so happens the company profiled in the article is U.K.-based retailer Next (LSE:NXT.L). The company runs 700 stores that sell clothes, furnishings, and your traditional department store fare, Barron's reports. It also boasts a robust online portal that gives the retailer access to consumers in 70 countries. As the headline notes, Next stock has already jumped double-digits this month. After falling off a cliff in early 2016 and trending lower for the better part of the past two years, Next shares look ready for an extended comeback.

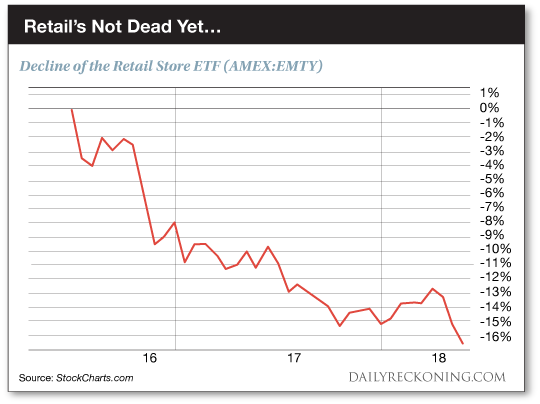

Next isn't the only big traditional retailer enjoying a comeback move to start the year. The SPDR S&P Retail ETF (NYSE:XRT) just capped off an impressive three-day run that pushed its year-to-date gains to almost 6%. This performance even edges out the red-hot Nasdaq Composite. Beleaguered retail names like J.C. Penney (NYSE:JCP), Macy's (NYSE:M), and even Sears Holdings (NASDAQ:SHLD) are helping lead the charge higher. These stores might be toast in the long run. But they could possibly enjoy an extended undercover comeback move this year as Amazon continues to attract all the media attention thanks to its online dominance. The anti-retail narrative is stronger than ever in 2018. But as we've said all along, there's more to the ?death of retail? story than struggling big-box retailers and dead malls. Last year, we noted some interesting statistics showing the condition of all retail establishments isn't as dire as the financial media insists. For instance, brick and mortar retail expanded in 2017 year ? even if they only highlight store closings on the financial news. By last estimate, U.S. retailers opened 1,326 more locations than they closed in 2017. We've certainly reached peak pessimism when it comes to brick and mortar retail. Thankfully, Wall Street rang the bell at the bottom with the launch of the Decline of the Retail Store ETF (AMEX:EMTY). [Editor's note: Yes, Decline of the Retail Store is the ETF's actual name, presumably to let clueless investors know exactly what they're buying.] Since its launch just a couple of short months ago, EMTY has dropped more than 16%.

It's easy to get swept up in the ?dead malls? and ?retail apocalypse? market memes. Unfortunately, following these media-driven narratives probably won't make you any money. As we've said from the start, the best retail operations will adapt and survive ? no matter what happens with Amazon. In fact, more than a few traditional retailers are booming because they're offering goods and services that are out of Amazon's reach. We've added many of these names to our portfolio over the past several months. We added Dollar General Corp. (NYSE:DG) to the portfolio as it rallied off a bullish earnings report. This trade is shaping up beautifully for us as the stock posts new all-time highs. Best Buy (NYSE:BBY) is another left-for-dead retailer that made it onto our list. The stock has launched straight up since mid-December. It's rallied almost 15% since we jumped onboard a few weeks ago. As the retail comeback continues to spread, we'll look to add more of these powerful snapback trades to our portfolio in the coming weeks? Sincerely, Greg Guenthner

for The Daily Reckoning The post The Retail Comeback is Real: Buy ?Dead Malls? Now appeared first on Daily Reckoning.  |