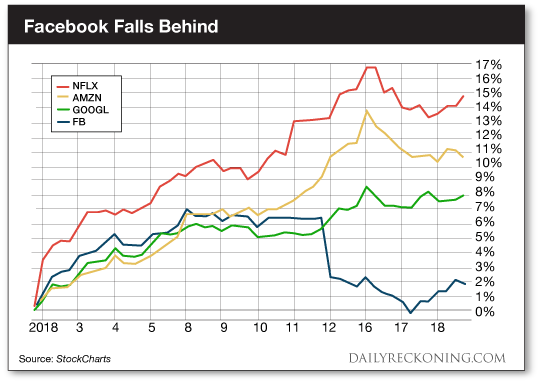

This post Is Facebook Finally Finished? appeared first on Daily Reckoning. Staring at your computer screen and smartphone all day is probably ruining your eyes. But your eyeballs are the least of your troubles. That's because your favorite social media app isn't just messing with your vision. It's probably affecting your mental health, too. The internet, smart phones, and social media are relatively new inventions. Researchers are barely scratching the surface when it comes to figuring out how our newfound reliance on internet likes and retweets are affecting our lives. The early results are grim. We're quickly turning into smartphone zombies. We can't walk from our driveways to our homes without burying our noses in our phones to complain about politics on our Facebook walls or like a few Instagram posts. Even former Facebook exec Chamath Palihapitiya concedes that social media is warping our brains and ripping society apart. That's a brutal assessment from someone with intimate knowledge of the company ? and Mark Zuckerberg has taken note. The company has already come under intense scrutiny for its failures to adequately vet false and misleading news stories on its platform during the 2016 election. Now we can add accusations of out-of-control online bullying and a system that's set up to be addictive (and destructive) to users' mental health. King Zuck has made it a priority to address these concerns directly. He even wrote about ?fixing Facebook? in his widely-read New Year's resolution post. But I don't believe the heat will let up anytime soon. Sure, Facebook has made money hand over fist. The stock is up more than 56% since the beginning of 2017. It's been a no-brainer trade that's handed us incredible gains many, many times. But the tide could be turning for this social media juggernaut. If more users and regulators begin to view Facebook as an unhealthy or dangerous pursuit, the company could be in for a rough ride. In fact, we're already seeing Facebook fall behind its FANG brethren.

Facebook shares are on pause to begin 2018, while Netflix, Amazon, and Alphabet (Google) are all streaking higher. Heck, even social media's red-headed stepchild Twitter is leapfrogging Facebook's recent performance. Twitter stock has recovered more than 50% over the past five months, compared to a paltry 7% gain posted by Facebook. Let's also not forget that Twitter shares have been dead money walking for years. Twitter's inability to innovate and properly monetize its platform has scared most investors away from the stock. Management ineptitude has always been the primary concern of analysts and investors. Shares traded as high as $70 shortly after its 2013 IPO. It's been a slow slog lower ever since. But the stock finally put in a bottom last year. With Facebook under intense scrutiny these days, we're seeing an opening for Twitter to build on this newfound momentum. A couple of key changes are already helping launch Twitter toward consistent profitability. In the past, Twitter relied on advertising dollars and promoted tweets for revenue. But a renewed focus away from ads is finally a strategy that's working in the companies favor. After all, Twitter controls mountains of data on its millions of users. This information is insanely valuable to other companies looking to better target their ad dollars. Sure, Twitter still has a lot of work to do before it can become the flourishing social media giant we all wanted it to be back when it first went public five years ago. But what we're seeing now is a good start. We've ridden the Facebook (NASDAQ:FB) bull to incredible profits. But now we need to take a step back. Let's close out this long-term position today and add to our Twitter Inc. (NYSE:TWTR) trade. It's time for the underdog to take the lead? Sincerely, Greg Guenthner

for The Daily Reckoning The post Is Facebook Finally Finished? appeared first on Daily Reckoning.  |