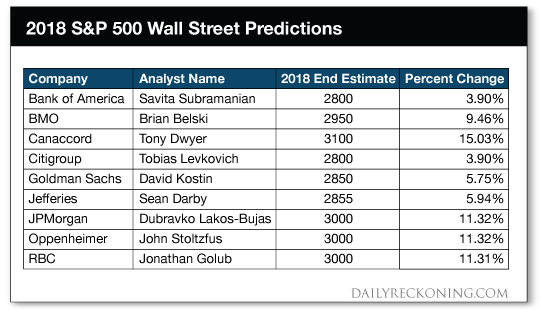

This post [Chart] Wall St. Isn't As Smart As You Think… appeared first on Daily Reckoning. Wall Street's top analysts have done it again, putting their reputations on the line to guess where the S&P 500 will end the year. Here are some of the top predictions?

The S&P started the year at 2,695, and Wall Street has declared that the bull market will continue marching on! The consensus expects growth of 8.66% in 2018. If Wall Street says so, it has to be accurate. Right? Not so fast. You see, for a bunch of Ivy-leaguers who spend 24/7 looking at markets, Wall Street isn't as smart as you think. Just look at how they predicted 2017 would turn out?

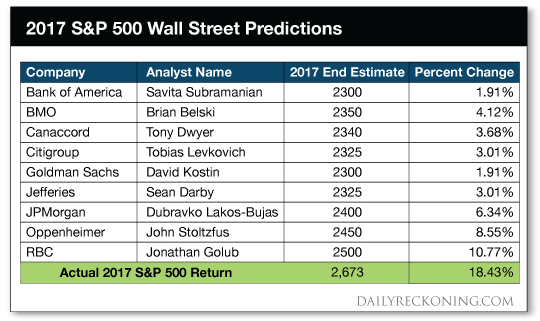

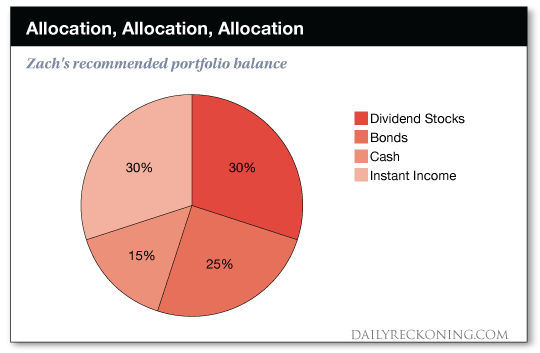

Not so great, huh? The actual S&P 500 return was over 18%. But 8 out of 9 analysts surveyed expected the S&P 500 to return less than 10%, while 6 out of those 9 were under 5%. And the one bull who did go out on a limb was still 8% away from where the S&P actually ended the year. Congrats, Jonathan Golub! You're the big winner ? or the smallest loser. Whichever you prefer! But why am I telling you this? Is it because I despise the big banks that game the system in their favor better than you and I ever could? Well, kind of? But I don't completely hate them! In fact, they actually make my life a lot easier by doing research that I use here at The Daily Edge. The real reason I'm telling you this is because whether you think so or not, you are qualified to manage your own retirement account. You don't need to pay outrageous management fees to a portfolio manager who only knows you as an account number and has dozens of other accounts bigger than yours. Because the truth is, nobody can correctly predict every gyration in the market. Even if you're a seasoned Wall Streeter like the analysts mentioned above. But what you can do is implement the same tools and strategies they use to drastically turn the odds in your favor ? things we talk about a lot here at The Daily Edge. Now let's get to our most important strategy? Stay allocated. You see, the bull market is raging on, which has many people emailing in about whether to invest more in stocks. So here's what I suggest. Divide your total investable assets into slices. Below are the allocations that your Editor Zach Scheidt recommends?

Now look back at your portfolio and figure out where you're overweight and where you're underweight. Do you have excess funds invested in bonds, cash or instant income that could be better used in dividend stocks? That's how you'll know whether to invest or not. Don't let the "fear of missing out" influence your retirement. Now stick with The Daily Edge as we recommend investments to fill in the pie. Here's to keeping your edge,

Davis Ruzicka

Managing Editor, The Daily Edge

Facebook ? Email Editor's Note: If you're interested in any sectors that we haven't talked about in a recent alert, feel free to send us an email at EdgeFeedback@AgoraFinancial.com. And stay tuned to see if your email is referred to in the coming days. The post [Chart] Wall St. Isn't As Smart As You Think… appeared first on Daily Reckoning.  |