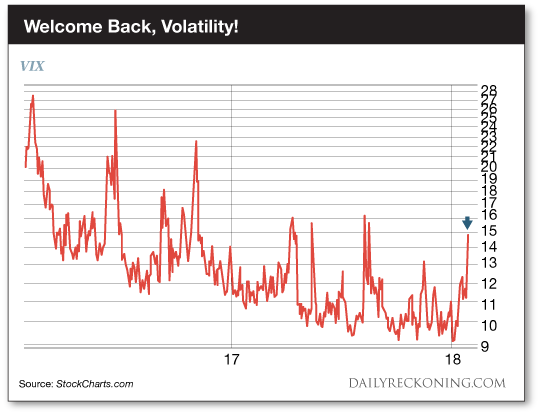

This post So You're Worried About a Stock Market Correction… appeared first on Daily Reckoning. The S&P 500 just suffered its worst trading day since August. The record run of low volatility we've enjoyed has official warped our minds. Even the smallest moves lower feel like a big deal. The S&P lost just 31 points on Tuesday ? a measly 1% drop. Yes, you read that correctly: The S&P 500 dropped more than 1% during a single trading session for the first time in five months? Stocks are finally taking a breather. Instead of hitting new highs every single day, we're actually witnessing some selling creep into the markets. After snapping back to life to begin the trading week, we were treated to another nice spike in the Volatility Index. The VIX has come back to life, jumping to levels we haven't seen since last summer after starting the year at historic lows.

The hysteria surrounding this little drop is laughable. Investors don't know what a real pullback looks like anymore. We have to keep a level head and remember this decline doesn't count as a correction. Heck, it's not even a true pullback yet. Despite what the financial media is saying, what we're seeing this week is normal stock market action. Stocks are supposed to go down sometimes. It's not the end of the world! Investors aren't the only ones with a screw loose right now. Even indicators like the VIX are flashing crazy signals. After the 30% surge we've witnessed in the VIX this week, Bloomberg notes that the volatility gauge is already pointing to a market bottom. This signal has occurred just four times over the past year. Each one marked the beginning of a meaningful bounce in the S&P 500. We're only two days into a small decline in the major averages and the fear gauge is telling us more gains are in the cards. That's nutty. Especially when you consider that this dip has done nothing to take the pressure off the market's wild move higher. Remember, the major averages are still enjoying their third-longest streak without experiencing a 5% drawdown since 1930. The S&P 500 hasn't even posted a 3% decline since November 2016 (an all-time record). As always, the subset of investors who have patiently sat on their hands to buy the dip are the ones getting screwed if the market erases this week's small loss and continues its nosebleed ascent. Right now, we only need to know two things about this market: 1. Stocks are white-hot. 2. The market can't go straight up forever. I can't tell you exactly when a real pullback is coming. What we do know is that when it happens, no one will be ready for it. Investors talk a big game about buying the dip. But when an actual dip-buying opportunity presents itself, many of these tough traders won't pull the trigger. One of this year's pullbacks will offer alert traders a tremendous opportunity while everyone else is running for cover. That's why it's so important to plant the idea in our heads now. Anything can happen in the markets. As long as we stay vigilant, we'll continue to rake in consistent gains. For now, I recommend going on a ?media diet? as the noise about a potential correction intensifies. You don't have to pull the plug on your internet connection and hide in your basement. But it's important to avoid overwhelming your brain with a ton of bias-confirming market opinions that could cause you to act against your best interests. Treat this week like any other. Trade your setups, honor your stops, and expect the unexpected… Sincerely, Greg Guenthner

for The Daily Reckoning The post So You're Worried About a Stock Market Correction… appeared first on Daily Reckoning.  |