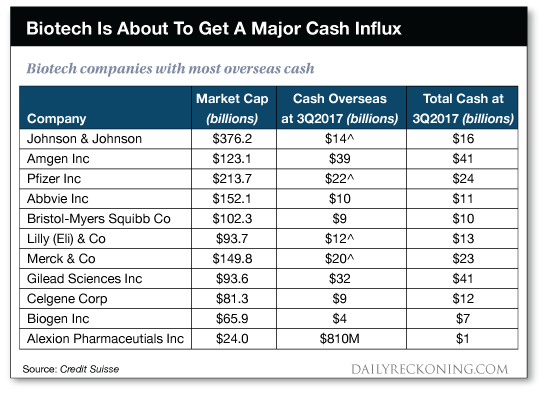

This post How to Cash in on Biotech's ?Takeover Fever? appeared first on Daily Reckoning. Every investor loves when one of their stocks is bought out for a big, juicy premium. I certainly do. Takeovers are one of the fastest ways to bank BIG gains in less than 24 hours. That's why I am digging into the biotech sector right now. This sector has a serious case of takeover fever. So today, I'm playing doctor to diagnose the two big causes of this takeover fever. And then I'll tell you how to profit from it? Takeover Fever Cause #1 ? They Are Handing Out Free Cash!Check this deal out. You're going to love it. On Monday, French pharma powerhouse Sanofi announced that it would be purchasing Belgian biotech company Ablynx for $4.8 billion in cash. This was just weeks after competitor Novo Nordisk offered to pay $3.1 billion for Ablynx. So to just say Sanofi came in with a sweeter offer wouldn't be doing it justice. The company is willing to pay a 112% premium to Ablynx's January 5, 2018 share price ? which was the last close before the Novo offer. That's literally twice what the market valued Ablynx at the start of 2018. As you can imagine, Ablynx shareholders are dancing in the street. But here's the interesting part? Sanofi's CEO disclosed that the company would fully finance this $4.8 billion purchase with borrowed money.1 Then he revealed the interest rate Sanofi would be paying on that borrowed money? Are you ready for it? That interest rate will come in around one percent! Can you now see why Sanofi agreed to buy Ablynx at that ridiculously high price? Because they can finance it almost for free! But Sanofi isn't the only big pharma that has access to this free money ? meaning you have a chance to catch a piece of the next big buyout. And it could happen soon, thanks to the second cause of takeover fever? Takeover Fever Cause #2 ? Tax Plan Cash WindfallIn late December, President Trump signed the most financially influential piece of legislation this decade. I'm talking about his much-anticipated tax plan. If you haven't followed the story, it is pretty simple. The tax bill gives companies with cash stored overseas a reason to celebrate. Because instead of paying a 35% tax on repatriation of that cash, they can now pay a one-time rate of just 15.5%. But while many people have talked about the popular tech sector benefiting most, let me be the first to say that the little-talked-about biotech sector is set to benefit just as much. Take a look at this stat? Of the top 30 companies in the S&P 500 with the most cash overseas, 11 of them are biotech firms. That's just as many as the technology sector ? without all the hype!

Combined, these companies hold a whopping $171 billion overseas? on top of the cash they have at home. So the tax reduction is a huge deal to these companies, as tens of billions of dollars are now freed up and ready to be spent? Money Is Falling From The Sky ? But Where Will It Land?With debt markets willing to throw free money at big pharma companies and Trump's tax plan creating a cash windfall from overseas, the biotech sector now has more buying power than ever. Now here's how we play this trend? I recommend you avoid trying to figure out which single biotech stock to own and instead grab a piece of the whole of the biotech buyout market. Global X Longevity Thematic ETF (NASDAQ:LNGR) ? This ETF seeks to invest in companies positioned to serve the world's growing senior population through exposure to health care, pharmaceuticals, senior living facilities and other sectors that extend quality of life in advanced age. But most importantly, the currently average market cap of the fund's holdings is only $14 billion. That means a major chunk of the companies held in this ETF are small enough to be acquired. You'll need to get in soon, though. With the tax plan officially announced, the big players in the space are finally putting that overseas capital to work. Here's to looking through the windshield,

Jody Chudley

Credit Analyst, The Daily Edge

Facebook ? Email Zach's Note: I hope you enjoyed Jody's article. But I'd like to expand on his takeover theme? because I've also predicted a MAJOR wave of mergers and acquisitions in 2018 ? all thanks to Trump's tax bill. And to prepare my subscribers, I recently released my "side project" that helps me pinpoint exactly which stocks are set to spike BEFORE it happens. Which can net gains as big as 248%? 419%? 644%? and even 1,177% overnight. >>>Click here to be an insider<<< 1 BRIEF-Sanofi CFO sees cost of debt to finance Ablynx acquisition around 1 pct, Reuters The post How to Cash in on Biotech's ?Takeover Fever? appeared first on Daily Reckoning.  |