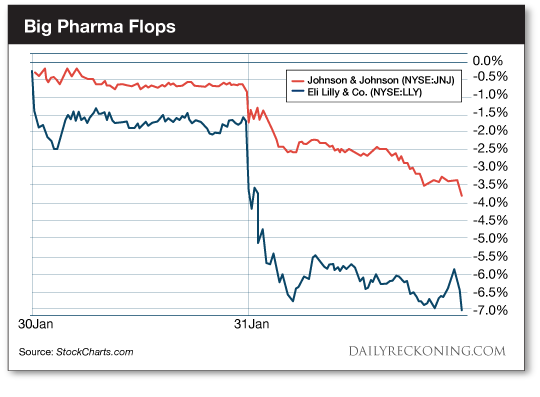

This post How to Make $300 Million as Health Care Collapses appeared first on Daily Reckoning. Short sellers are having a tough time. The market's record-setting run has repeatedly mauled the bears. Investors continue to pile into stocks as they approach nosebleed territory. Few vulnerable plays are offering major paydays for the shorts ? until this week. Short sellers just booked $294 million in a single day on a rare triumph against the health care sector. Traders booked their gains on the iShares US Healthcare Providers ETF (NYSE:IHF) as it plummeted from its all-time highs earlier this week, Business Insider reports. The health care slump was triggered by the Bezos-Buffett-Dimon cartel when the trio announced that Amazon, JPMorgan Chase, and Berkshire Hathaway are teaming up to disrupt the health care industry. Health care providers sold off on the news (it also didn't hurt that the major averages also had a bad day). But the health care selloff didn't end there? Pharmaceutical stocks joined the party Wednesday after Trump dredged up drug pricing concerns during his State of the Union address. Every major drug manufacturer retreated yesterday. Eli Lilly & Co. (NYSE:LLY) led the way lower with a decline of more than 5%. Johnson & Johnson (NYSE:JNJ) and AbbVie (NYSE:ABBV) weren't far behind with losses of 3%.

While Bezos & Co. could eventually turn the health care market on its head, Trump's concerns over drug prices shouldn't alarm investors, especially when you consider that the administration has yet to act with any concrete plans. After all, Trump has spoken out against drug companies going all the way back to his 2016 campaign. So far, it's been nothing more than a throwaway talking point. The pharmaceutical industry has found itself in the crosshairs of politicians on both sides of the isle. Both the Clinton and Trump campaigns temporarily derailed biotech stocks during campaign season in 2016. Trump condemned the massive drug price increases that have made headlines over the past few years. To kick off 2017, Trump complained about ?astronomical? drug pricing during a White House meeting with a group of pharmaceutical CEOs. He also took issue with where these drugs are made, telling industry leaders that they need to expand U.S. manufacturing. It was the health care sector's first big sentiment test of the year. Thanks to all the election controversy, the Health Care Select Sector SPDR (NYSE:XLV) had just registered its first annual loss since 2008, underperforming every other major sector on the market in 2016. But the health care sector exploded out of the gate in 2017. It was the strongest sector on the market during the crucial first trading weeks of the year. And even as Trump tried to talk these stocks down, they fought out of their collective funk. The rest is history. One year later, the Health Care Select Sector SPDR is higher by more than 30%. The shorts have already cashed in on a bad week for health care stocks. While health care providers might be in trouble in the long run, the drug manufacturer slump probably won't stick. Using recent history as our guide, these stocks will likely brush off any weakness related to this week's political posturing and continue to outperform in 2018. Sincerely, Greg Guenthner

for The Daily Reckoning The post How to Make $300 Million as Health Care Collapses appeared first on Daily Reckoning.  |