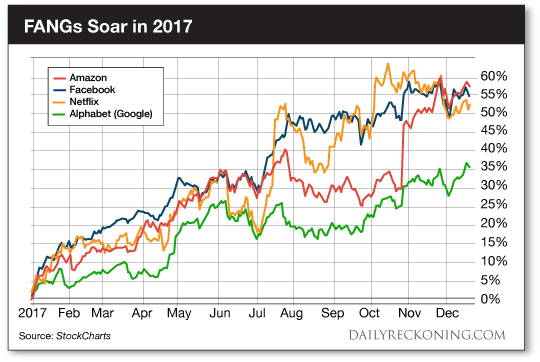

This post FANG's $90 Billion Disaster appeared first on Daily Reckoning. The stock market has settled down after Monday's big drop. The Dow Jones Industrial Average finished Wednesday trading just in the red after a volatile start to the week. Meanwhile, the Nasdaq Composite was yesterday's biggest loser. The tech-heavy index slipped late in Wednesday's session to finish the day down almost 1%. We have a chance to take a step back and survey the damage now that stocks have calmed down a bit. Our mission is to figure out which areas of the market are most vulnerable after Monday's rout ? and which stocks have a shot at becoming new market leaders once the dust settles. We'll begin our investigation with the most popular stocks on the market: The FANG's (Facebook, Amazon, Netflix, and Google). I don't have to tell you that these are a handful of the most powerful tech names on the market. Each of these stocks trounced the averages in 2017. Buying the FANGs quickly morphed into a ?can't lose? investing strategy. Everyone was cashing in on the market-beating performance.

But I flipped the script back in December when I guessed that the easy ride for the FANG stocks was finally over. In short, I predicted the FANGs would stop rocketing higher every month. Some would even underperform the averages. I expected many of these world-beating stocks to come under pressure in 2018 because of how well they had performed. Facebook and Google were already attracting negative attention over privacy concerns late last year. There are others questioning whether Amazon is quickly becoming a retail monopoly. We're overdue for some backlash. Sweetheart status for even the most popular companies is never permanent. Of course, it's no surprise that the FANGs took a hit when Monday's selloff struck. The group collectively lost more than $90 billion in market value by the end of the day, according to CNBC.

Despite Monday's hit, each of these stocks remained in the green for the year. But that might not last? Yesterday's action featured more downside action from the FANGs as the broad market attempted to stabilize. Facebook and Google were the hardest hit of the crew. Both stocks dropped nearly 3% on the day, badly trailing the Nasdaq Composite. Google is now barely green on the year (the stock had gained more than 12% year-to-date last month). Facebook is up just 2% in 2018. Amazon and Netflix are each maintaining their scorching trajectories for now. Time will tell if these two names can maintain their breakaway moves. To be clear, I don't want to tempt death by shorting any of these powerful companies. But as I said back in December, it's time to break up the FANGs. The entire investing world is lumping these household names into one. The contrarian in me says that means it's time for them to go their separate ways. Each of these companies is fighting to win the top spot in tech. For the most part, they trended together in 2017. That can't last forever. We're already seeing the start of Google and Facebook lagging badly behind Netflix and Amazon. If this separation continues, the FANG meme will die a quick death and investors will once again view these stocks more on their individual merits. As the FANGs take a back seat, other big players will take their place on our list of outperformers. We'll pay close attention to see what the market reveals as we approach the end of a wild trading week? Sincerely, Greg Guenthner

for The Daily Reckoning The post FANG's $90 Billion Disaster appeared first on Daily Reckoning.  |