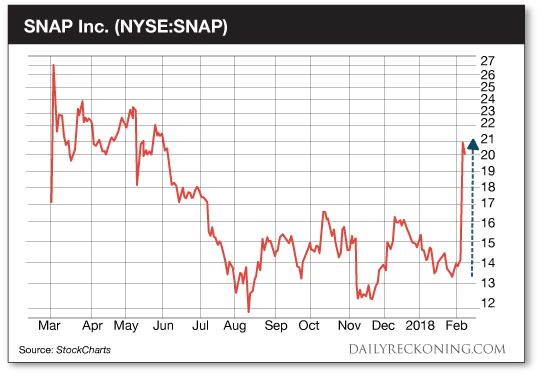

This post [3 Must-See Charts] Testing the Lows appeared first on Daily Reckoning. It was another rough day for the markets. The major averages fell off a cliff yesterday afternoon to finish the trading day at the lows. The Dow Jones Industrial Average coughed up another 1,000 points to post a 4% drop. The S&P 500 and Nasdaq Composite weren't far behind. Aside from a couple positive earnings surprises, few stocks were safe from Thursday's drop. This morning, the selling is continuing in European and Asian markets. If stocks continue to slide into the weekend, the Dow might post its worst weekly performance since 2008. Yikes! It's all too easy to get caught up in the panic. The correction blame game has rotated from volatility traders to rate hikes to fears of a government shutdown as the week progressed. No one wants to admit that stocks simply drop sometimes ? especially after historically smooth runs higher. Let's turn to some ?chart therapy? to get the bad taste out of our mouths today: 1. The Ultimate ?SNAP-back? Move?In true correction fashion, one of the strongest moves this week comes courtesy of one of Wall Street's most hated stocks. I'm talking about Snap Inc. (NYSE:SNAP). I've given Snapchat a hard time ever since the stock's doomed debut. The company couldn't seem to get its act together right out of the gate. Investors weren't interested in buying shares of a trendy social media stock that was having trouble making any headway against Facebook. But Snap is quickly turning things around. The company shocked Wall Street earlier this week when it actually beat earnings estimates, shooting shares higher by more than 50%. It even earned a couple of analyst upgrades?

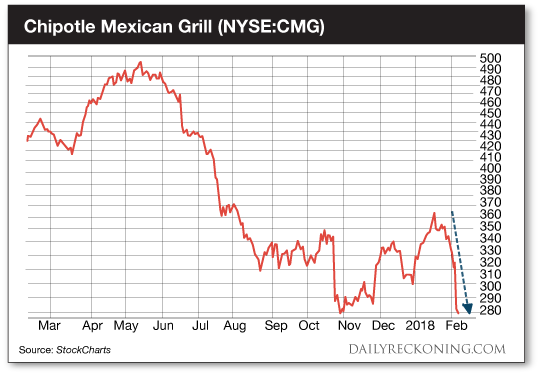

After almost one year of pain as a public company, SNAP shares are back above their IPO price. Perhaps this move is the start of a long-term recovery. 2. No Sign of a Burrito BottomWhile SNAP crushed earnings and gained more than a few new followers, investors bashed shares of Chipotle Mexican Grill (NYSE:CMG). Chipotle topped earnings estimates this week. But there was plenty of bad news to go along with the burrito joint's earnings beat. Chipotle management expects the chain to continue to suffer from decreased foot traffic and slow same-store sales growth. It goes to show that beating analyst numbers just isn't good enough sometimes ? especially in an unforgiving market environment like we experienced this week.

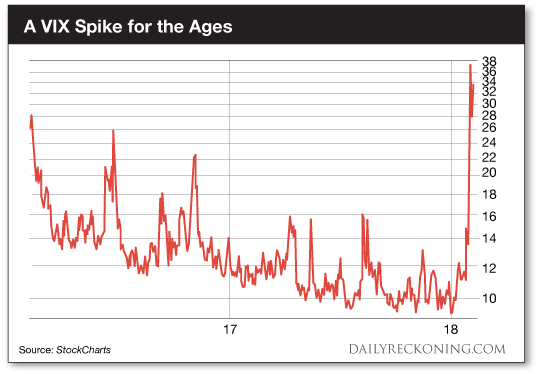

CMG shares tanked to levels we haven't seen since 2012. Judging by this dismal price action, we shouldn't hold our breath for a Chipotle turnaround anytime soon. 3. Welcome Back, VolatilityEveryone's been talking about the return of market volatility this week. But you have to see this chart of the CBOE Volatility Index to gain a full appreciation for the change in the market's character this week:

The volatility index had trended toward historic lows for the better part of the past two years. Every spike in volatility was followed by lower lows. But this week's shock has rocketed the VIX into the stratosphere. The market's ?fear gauge? has officially put Wall Street on edge. Meanwhile, our mission remains the same. We'll continue to stay focused and explore ways to exploit these new volatile conditions for gains. Sincerely, Greg Guenthner

for The Daily Reckoning The post [3 Must-See Charts] Testing the Lows appeared first on Daily Reckoning.  |