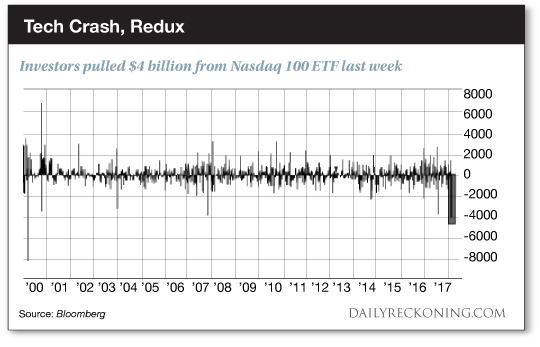

This post Now's Your Chance to Buy This Dip… appeared first on Daily Reckoning. The major averages added to their Friday gains to start the new trading week. The Dow tacked on another 400 points. The S&P 500 finished higher by 1.4%. Even bitcoin is gaining ground… But many investors aren't convinced this bounce will stick. They're pulling their money out of the markets because they're certain a bigger correction is just over the horizon. To be fair, we don't know if the market is going to shoot right back to new all-time highs after last week's terrifying drop. But we don't need to sit on our hands waiting for stocks to set new bullish records. Instead, we'll follow a simple mantra to pinpoint our best shot at comeback gains: Strong trends usually persist. As stocks streaked higher to begin the year, we knew a pullback was eventually in the cards. Now that the averages have corrected more than 10% from their all-time highs, we're peeling back the market's layers to uncover clues that will lead us to some potentially profitable trades. So far this week, some familiar sectors are starting to separate from the pack.For instance, tech stocks are taking the baton as stocks fight off their lows. But most folks aren't buying into the strength we're seeing in the tech sector right now. Skittish investors have been dumping tech stocks in record numbers as the market started wobbling. In fact, they pulled nearly $4 billion from the PowerShares QQQ Trust ETF last week, according to Bloomberg. That's the most money yanked from tech ETF since the days of the dot-com bust.

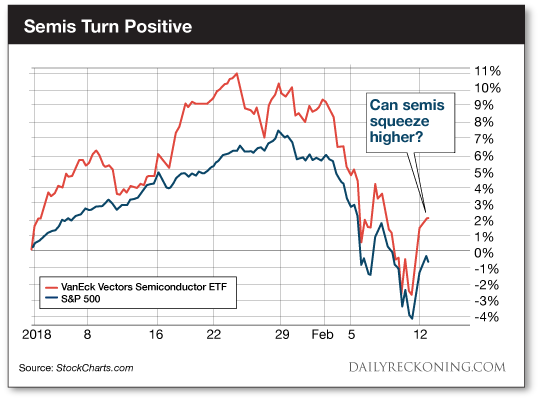

Think about this for just a moment: Investors are more afraid of the tech sector now than they were during the financial crisis. The herd clearly believes that the strongest stocks on the market will be the ones that have the farthest to fall if market weakness persists. But we're not so sure about that? Remember, big tech was a major player at the start of the January rally, with stocks like Facebook (NASDAQ:FB) and Amazon.com (NASDAQ:AMZN) juicing returns right out of the gate. Fast-forward to this week and we're already seeing Apple Inc. (NASDAQ:AAPL) leading stocks out of the cellar. After a brief trip below its 200-day moving average, Apple jumped by more than 4% yesterday. Apple wasn't the only tech darling ricocheting higher yesterday. The VanEck Vectors Semiconductor ETF (NYSE:SMH) busted out of its funk to trade higher by more than 2%.

SMH is now positive on the year ? while the S&P 500 is still trying to find its footing. The ETF's performance is even more impressive when you factor in that one of its biggest holdings, NVIDIA Corp. (NASDAQ:NVDA), took a hit yesterday. The stock finished the day down almost 2%. As we've said since the very beginning of 2018, one of this year's pullbacks will offer alert traders a tremendous opportunity while everyone else is running for cover. This could very well be that big opportunity to scoop up shares on the cheap while most investors are watching from the sidelines. Sincerely, Greg Guenthner

for The Daily Reckoning The post Now's Your Chance to Buy This Dip… appeared first on Daily Reckoning.  |