This post The Anti-China ?Silver Bullet? appeared first on Daily Reckoning. "Oh yeah? Well, I'm going to charge you extra for every piece of steel you send our way!" "Really? Try this: We're not going to sell any more Harley Davidson's in our country!!"

"Fine!! See how you like it when we don't buy any of your fancy BMW's or Audi's!!!" "Well in that case, we're going to ban Levi's jeans. In fact, to hell with ALL American apparel brands!!"

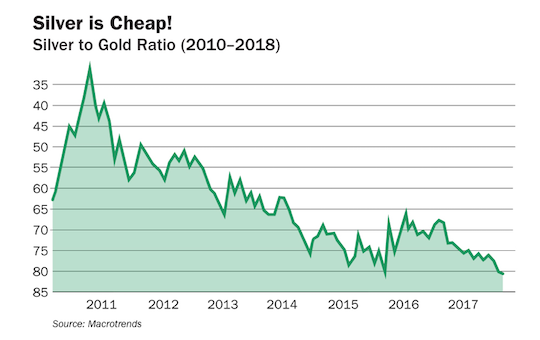

And so the shouting match has started. It seems we're on the cusp of a global trade war. Of course politicians, economists and business owners can take sides and make eloquent arguments about the pros and cons of each move. But that's not my forte. Instead, I want to show you the best ways to make money as the economic shouting match rages on? What's the Best Way to Protect Against Chaos?If anyone tells you they know exactly how a trade war will play out, they're crazy. After all, we're talking about decisions that will be made by leaders of many different countries. And those leaders are locked in a chess match (or more accurately, a "power struggle") to try to protect and grow their own economies. We could see tariff's (essentially taxes on imports) levied on all sorts of products and services. Or we could see different one-off deals struck between individual countries. And while I can't tell you exactly how it will all play out, I can tell you that we're entering a much more chaotic period for the economy and for our financial markets. So as an investor, what do you do when chaos picks up? Well, one of the best ways to protect your wealth over the ages has been to own precious metals! Precious metals like gold and silver have done a great job of helping people preserve their wealth ? especially during chaotic periods! And if investors get particularly fearful, we could see a panic rush into gold and silver that would push prices sharply higher. (Of course the lucky investors who are already invested in gold and silver will make a windfall profit when this happens.) So what's the best way to play a trade war gold surge? I think I've got the perfect "silver bullet" for you today? Maximize Your Gains as Precious Metals SurgeWhen it comes to precious metal investments, most people immediately think about gold. After all, gold is one of the most "precious" elements in terms of how much it costs per ounce. But as an investor and trader, I'm actually much more intrigued by the profits you can expect from silver. There are two primary reasons I would choose silver over gold right now. First, silver is not just a precious metal, but also an industrial metal. There are many practical uses for silver including medical properties, silver is used in semiconductors and other technology products, and silver is a key component of solar energy panels (which will become more and more prolific as our demand for electricity increases). So demand for silver should pick up not just from the investors who are looking for safety with precious metals, but also from various corners of the growing economy that need silver to stay in business. Second, right now silver is far cheaper when compared to gold than it has been in a very long time. Take a look at the chart below. This chart shows how many ounces of silver you can buy with one ounce of gold.

The lower the line moves, the less expensive silver is compared to gold. So right now, it takes 80 ounces of silver to pay for just one ounce of gold. Seven years ago, that ratio was a lot closer to 32 ounces of silver. Given the strong demand for silver in our growing economy, I expect this ratio to move back to a more "normal" level. And that means the price of silver should rise much more quickly than the price of gold. In fact, if we see gold move 50% higher over the next year, the price of an ounce of silver should rise 100% or more! That's the kind of explosive growth you can expect from an area that is attracting much more investment capital, and one particular metal that is rising much faster than the average precious metal. To take advantage of this shift, I recommend owning some physical silver in the form of coins or silver bars. But you can also speculate on the price of silver with the iShares Silver Trust (SLV). This ETF closely tracks the actual price of silver. Finally, you may want to buy shares of precious metal miners that focus on silver production. Companies like Wheaton Precious Metals (WPM), Coeur Mining Inc. (CDE) and SSR Mining (SSRM) all have significant silver operations and should do very well as silver prices shoot higher. So please keep these stocks on your radar! It's important to go ahead and get started protecting your wealth right away. Because if you wait until this trade war escalates, you'll likely have to pay higher prices to get your hands on precious metal investments. Here's to growing and protecting your wealth!

Zach Scheidt

Editor, The Daily Edge

Twitter ? Facebook ? Email The post The Anti-China ?Silver Bullet? appeared first on Daily Reckoning.  |