This post This Man Turned $10,000 Into $$850,000? Let's Follow Him appeared first on Daily Reckoning. Hedge fund legend Julian Robertson loves shares of the Canadian airline Air Canada (ACDVF), and it isn't hard to see why. Shares of this dominant Canadian carrier trade for just three times earnings. That is a fraction of the valuation that the market currently assigns to Air Canada's peers that operate south of the border. It makes you wonder how Air Canada slipped past another legendary billionaire investor who has developed a recent love for the airline industry. Let me explain? Warren Buffett's $10 Billion Bet On The AirlinesFor a guy who is famous for being a very picky investor, Warren Buffett certainly got very excited about the airlines. Over the past several years, he has invested billions in four different operators. As of March 31, 2018, Warren Buffett's company Berkshire Hathaway owned the following: - 53.5 million shares of Delta Airlines (DAL) worth $2.9 billion

- 47.7 million shares of Southwest Airlines (LUV) worth $2.7 billion

- 46.0 million shares of American Airlines (AAL) worth $2.4 billion

- 27.7 million shares of United Continental (UAL) worth $1.9 billion

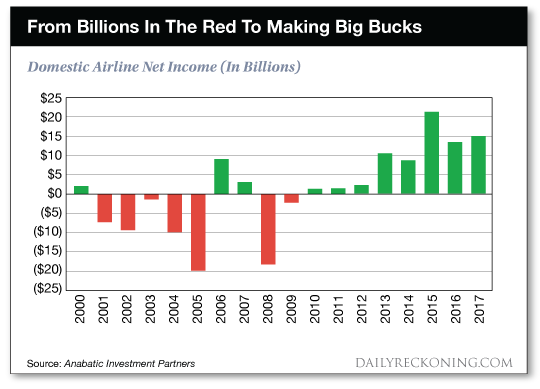

That is a combined $9.9 billion investment. Even for Warren Buffett, that is real money. Buffett doesn't commit that kind of capital without having a very high level of conviction about his investment working out exceptionally well. It is important to note that Buffett didn't just buy one particularly standout airline, he bought all four of the major American operators in the industry. But he should have taken a look north of the border as well ? as he could have gotten a much better bargain? If You Like Airlines ? Air Canada Is Available At A Discounted PriceLike his fellow billionaire Warren Buffett, Julian Robertson sees the airline industry as a place to invest today. If you were wondering why we should care what Julian Robertson thinks, let me tell you a little bit about his investment track record. From 1980, when he launched his hedge fund, Tiger Management, until when he closed it in 2000, Robertson generated an annualized rate of return of 25 percent for his investors.1 That is an incredible 20 year run, virtually unmatched in the business. Initial investors who got in on the ground floor with Robertson made 85 times their initial investment. If you had put $10,000 into Robertson's fund in 1980, you would have been pulling out $850,000 twenty years later. A $100,000 investment would have turned into $8.5 million. Those are life changing investment returns ? similar to what Warren Buffett's early investors experienced. Today, Buffett and Robertson are both invested in airlines. The reason for that is no mystery? It is because the airline business has changed. These companies now generate huge profits? unlike before. Over the nine years ending in 2009, the airline industry lost $54 billion. Since then, the industry has made almost $70 billion.

The driver of this improvement in profitability is the consolidation of the operators in the airline industry. No longer is this industry fragmented and undisciplined. Consolidation has ended the boom-and-bust pricing cyclicality that the industry has always dealt with. The worst operators are gone. Today, the consolidated airline industry is much more efficient and focused on return on capital invested rather than senselessly chasing market share. The industry now resembles other profitable industries that are dominated by a few major operators. Buffett has chosen to place his investment bet on the four major American airlines. Julian Robertson, meanwhile, prefers Air Canada and it sure looks like he is onto something. While the American airlines (Delta, Southwest, American and United) trade at a price to earnings ratio between 8.5 and 10.4 times, Air Canada trades at a paltry 3.2 times earnings. Air Canada would need to triple in price to trade at a valuation equal to the major U.S. airlines! To put how cheap that is into perspective, consider that it will take Air Canada only three years to earn an amount equal to its entire current market capitalization (share price multiplied by number of shares outstanding). That is cheap, cheap, cheap! If Buffett is right and the airline sector is a great place to be investing, it sure looks to me like the way to do it is to follow Julian Robertson's lead and take advantage of this extreme Canadian discount. Then just sit back, relax, and enjoy a smooth ride. Here's to looking through the windshield,

Jody Chudley

Financial Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com 1 The End of the Game; Tiger Management, Old-Economy Advocate, Is Closing, New York Times The post This Man Turned $10,000 Into $$850,000? Let's Follow Him appeared first on Daily Reckoning.  |