With tech stocks looking like an increasingly risky bet, analysts have been getting more bullish on some key defensive names…[Here are] 5 ?Strong Buy' defensive stock picks that have received only buy ratings from top analysts in the last three months.  This version of the original article, by Harriet Lefton, has been edited* here by munKNEE.com for length (?) and clarity ([ ]) to provide a fast & easy read. This version of the original article, by Harriet Lefton, has been edited* here by munKNEE.com for length (?) and clarity ([ ]) to provide a fast & easy read.

Let's take a closer look: 1) Merck (MRK) Merck & Co. is one of the world's largest pharma companies, delivering revenue in 2017 of over $40 billion. The pharmaceutical giant is seeing big and steady sales of its cancer drug Keytruda?[that] aids the body's own immune system to fight and kill cancer cells… On November 16th BMO Capital analyst Alex Arfaei (Track Record & Ratings) said: - ?If Merck maintains ~40% long-term share of the U.S. IO (immunotherapy) market, this would imply:

- sales potential of $7.4 Bn in the U.S. (this seems conservative given recent trends, especially given the recent FDA approval for Keytruda + chemotherapy for non-small cell lung cancer (NSCLC)

- and $9.4Bn by 2030 worldwide.

- The above estimates are plausible given Merck's strong execution in IO so far.?

Arfaei currently has an $80 price target on ?Strong Buy? rated Merck. Indeed, in the last three months, Merck has received five consecutive buy ratings from top-ranked analysts. This is with an average analyst price target of $82 (10% upside potential). (Click on image to enlarge)

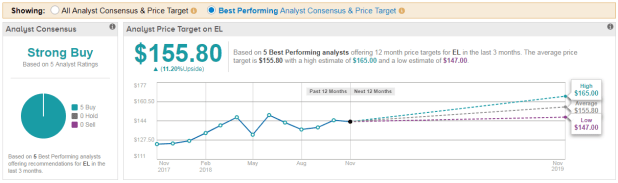

View MRK Price Target & Analyst Ratings Detail 2) Estee Lauder (EL) Beauty stock Estee Lauder has received a slew of recent buy ratings from the Street. Analysts are celebrating the company's high-quality earnings beat and bullish guidance, even with China-related risks priced in. Bear in mind, in the last one month, shares have rallied almost 13%. On October 31 five-star Oppenheimer analyst Rupesh Parikh (Track Record & Ratings) wrote: - ?We look very favorably upon the Q1 delivery and updated guidance?…calling the stock one of his favorite names in the consumer-packaged goods space.

- Notably, confidence in the stock should improve now that ?EL guidance has built in a moderation of sales growth in China and travel retail, the impact of all known tariffs including a planned increase in China, and announced closings of department stores?.

The analyst believes: - the company's leading position in the global prestige beauty category,

- a strong management team,

- and consistent M&A track record

can drive continued market share gain. Indeed, the prestige beauty category specifically has been growing at a faster rate than the lower-end mass products in eight of the past nine years. Overall, five best-performing analysts have published recent Buy ratings on the stock. Their average Estee Lauder price target of $158 indicates 11% upside potential. (Click on image to enlarge)

View EL Price Target & Analyst Ratings Detail 3) Pattern Energy (PEGI) With a focus on clean energy, Pattern Energy owns and operates 12 wind power projects in the U.S., Canada, and Chile. Oppenheimer analyst Colin Rusch (Track Record & Ratings) told investors on November 5: - ?With a dividend yield of ~9%, we continue to believe PEGI is significantly undervalued.

- We believe its underwriting practices are in line with industry best practices and its wind resource modeling capabilities are among the industry leaders.

- Moreover, Pattern Energy has first right of refusal over the purchase of a solid portfolio of assets, which Rusch believes can support ?superior stock performance' over the next couple of years.

In total, this ?Strong Buy' stock has an average analyst price target of $24. This positions the stock for close to 20% upside potential from current levels. (Click on image to enlarge)

View PEGI Price Target & Analyst Ratings Detail 4) Cigna Corp. (CI) U.S. health insurance stock Cigna is on track for its whopping $52 billion acquisition of Express Scripts to close by the end of the year. In addition to receiving Department of Justice (DoJ) approval in September, the companies have received approval from 23 states, with 6 left to go and analysts are optimistic about the stock's prospects going into this crucial period. Leerink analyst Ana Gupte (Track Record & Ratings) on November 19th: - raised her price target for Cigna to $260 from $250. Her new price target suggests prices can surge 23%.

Similarly, Cantor Fitzgerald's Steven Halper (Track Record & Ratings): - has just reiterated his Cigna buy rating…with a $245 price target saying: ?We continue to see many strategic benefits to the ESRX acquisition given its large footprint of third-party payers and self-insured employers, mail order and specialty pharmacy operations?.

With 11 top analyst buy ratings in the last three months alone, Cigna scores a ?Strong Buy' analyst consensus. We can also see that the average analyst price target currently stands at $251 (19% upside potential). (Click on image to enlarge) View CI Price Target & Analyst Ratings Detail 5) Trupanion (TRUP) Last but not least we have Trupanion, a pet insurance company for cats and dogs. What sets Trupanion apart is that its insurance policies come with no payout limits. On November 9th 5-star RBC Capital analyst Mark Mahaney (Track Record & Ratings): - described the company as ?Off the leash? is following its stellar Q3 earnings report,

- reiterated his Trupanion buy rating…with a $44 price target. Given that the stock is currently trading at just $25, his target translates into upside potential of over $70.

- wrote in his investor report:

- ?We view TRUP's top-line results as encouraging, with EBITDA and pet growth continuing to outperform expectations…

- we continue to believe TRUP has the characteristics of a high-growth, subscription-based, 'Net company and benefits from a highly recurring model, which adds predictability?.

- He believes Trupanion is facing a massive total addressable market of more than $3 billion to $5 billion and calls the shares ?an attractive investment' so long as there's no significant, unexpected slowdown in pet policy growth.

Overall, this ?Strong Buy' stock has a bullish $42 average top analyst price target (58% upside potential). (*The author's views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)For the latest ? and most informative ? financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here). If you enjoyed reading the above article please hit the "Like" button, and if you'd like to be notified of future articles, hit that "Follow" link. The post 5 'Strong Buy' Defensive Stock Picks From the Industry's Top Analysts appeared first on munKNEE.com. |