This post Here's What Happens Next appeared first on Daily Reckoning. Good morning! And grab a cup of coffee? Because today we're shaking things up at the Daily Reckoning. I'm Greg Guenthner, CMT. And I'm kicking off a new addition to your subscription that will land in your inbox every Tuesday and Thursday morning. Consider it a supplement to the usual Daily Reckoning musings you enjoy from Brian Maher, Jim Rickards, Zach Scheidt, Ray Blanco and others. As you know, the Daily Reckoning brings you the most insightful, most concise market information available. But this brand-new Morning Reckoning takes it even further ? giving you a completely unfiltered look at what we're seeing. I hope you'll find this information highly valuable as you try to navigate today's wild markets. Yes, I know the day is just getting started. So let's get those gears turning by taking a look at where we are now? and which way they're headed next. Because this isn't your nephew's bull market?

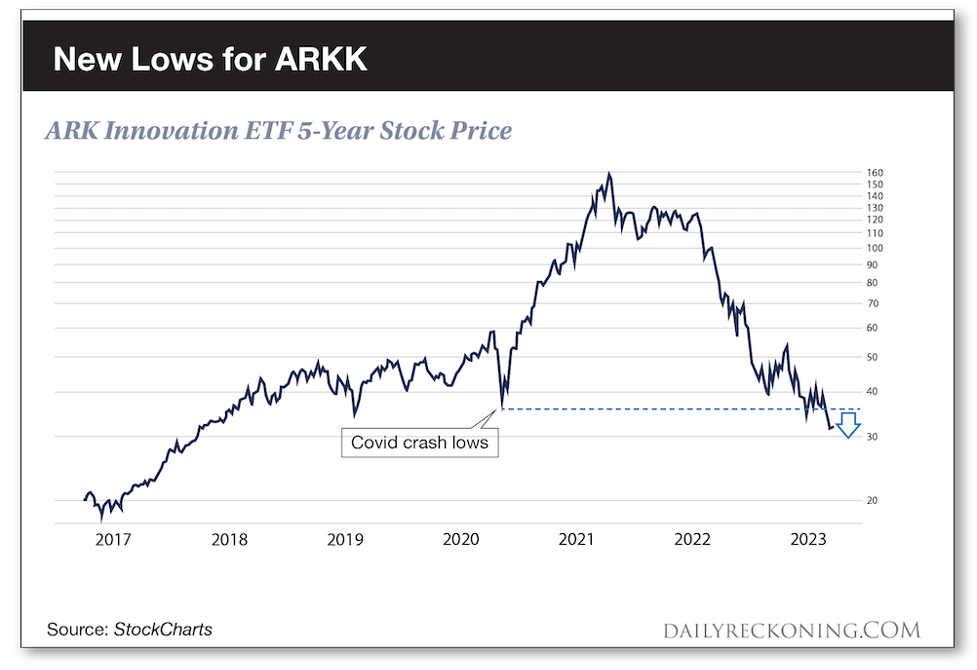

Here's What Happens NextThis isn't your nephew's bull market. You've probably figured out as much watching the major averages post their first significant annual losses since the depths of the Great Financial Crisis. The Nasdaq's 33% skid wasn't the only pain point, or course. The tech blowout steadily ripped through the other major sectors, dragging the S&P 500 down a cool 20%. Most of the former high-fliers have lost their luster, especially the heroes of the frothy post-Covid era. There are some other key differences, too. The folks hawking bizarre JPEG art have disappeared. Novice traders who made a few bucks blindly buying call options on meme stocks are back to square one. And your cocky young relatives who tried to convince you the crypto token they started mining during quarantine was going to the moon were strangely quiet at Christmas dinner. You've seen all this (and more ? so much more!) play out in real time, so I'm not going to slog through a full 2022 recap. But since you haven't heard as much as a peep from me in more than a year, I'll take a minute to spill some virtual ink on the big, bad bear gnawing on the Nasdaq's carcass. Then, I'll reveal what opportunities might lie ahead when the dust clears. But first, how did we get here? To quote the incomparable Ed Seykota, the trend is your friend until it bends at the end. Or, to complicate the matter a bit, when something works very well in the markets, it attracts a lot of attention. When everyone finally agrees it's an infallible strategy that will never stop producing gains, that very same thing begins to sputter. That's when trends begin to bend. Then, they break. Nifty 50. Dot-com. BRICs. Innovation. The names change. People don't. This market action has been especially painful for anyone stuck using the Covid Bubble playbook. The days when you could mindlessly buy any tech stock and book profits are over. No more wide-eyed speculation in the buzzword sectors. No more meme stocks or message board wonders. Even a handful of household names have been cut in half ? or worse. Hindsight bias tricks us into thinking it all happened at once. But it didn't. There were plenty of hints that the tide was starting to turn more than one year ago. In fact, the speculative retail trading bubble was quietly bursting right under our noses in late 2021. Market leadership told most of the story. The S&P 500 was having a banner year, up more than 25% in 2021. Soaring mega-caps led the way. Everything else? Not so much. The frothiest stocks had peaked in early February and couldn't seem to find any momentum heading into the holiday season. Meanwhile, a few key groups were beginning to roll over. Remember Cathie Wood's now infamous ARK Innovation Fund (ARKK)? These tech-growth wonders doubled, tripled, and quadrupled (or more!) as the Covid Bubble inflated. But after many of these stocks peaked in early 2021, whispers about valuations turned to shouts by the fourth quarter. That's usually a sign that the magic has worn off. You'll never hear anyone complain about stocks being expensive when they're seeing their portfolio gain 10% every week. The narrative starts to flip once the fast gains fade. When the quiet selling started, follow-through in many of these momentum names waned into late 2021 and never fully recovered. Investors holding too many tech stocks in their innovation portfolios underperformed as the Nasdaq Composite lagged the S&P 500 for the first time since 2016. But the real pain began as the calendar flipped to 2022. All those growth stocks that couldn't possibly go any lower did, in fact, continue to fall. After rallying more than 325% off its Covid crash lows, ARKK has now round-tripped, slipping to new five-year lows in late December.

Maybe you're sick of thinking about the growth-y tech stock. But too many true believers continue to lurk around this space, desperately clinging to these plays in hopes of an unprecedented comeback. Unfortunately for them, it's going to take much more time before these stocks are viable again on the long side. Some will get bought. Others will go to zero. A handful will need time to create new bases as the market resets expectations. But ARKK won't see those 2021 highs for a long time ? if ever. If you're a nimble trader, you could take advantage of some snapback moves in tech if and when they materialize. We'll cross that bridge when we get to it? Meanwhile, you're going to find plenty of longer-term opportunities far from the tech space in 2023. Industrials and materials are strong. Select consumer staples names are posting new highs. The days of ZIRP are over. Growth is out. Value stocks are back in vogue. Adapt or die! Gold bugs are also making a little noise right now. If you're searching for momentum, miners are on the cusp of a bigger breakout. Most of these companies aren't great long-term bets. But they can really get rolling in the right environment? That should get your gears turning. We'll talk more about how you can profit from these ideas in the weeks ahead. Oh, and maybe you could pass this note to your nephew and his meme stock buddies? Now that the shock of 2022 has settled, planning for the new normal could help him move out of his mom's basement before the next bull market begins. The post Here's What Happens Next appeared first on Daily Reckoning. |