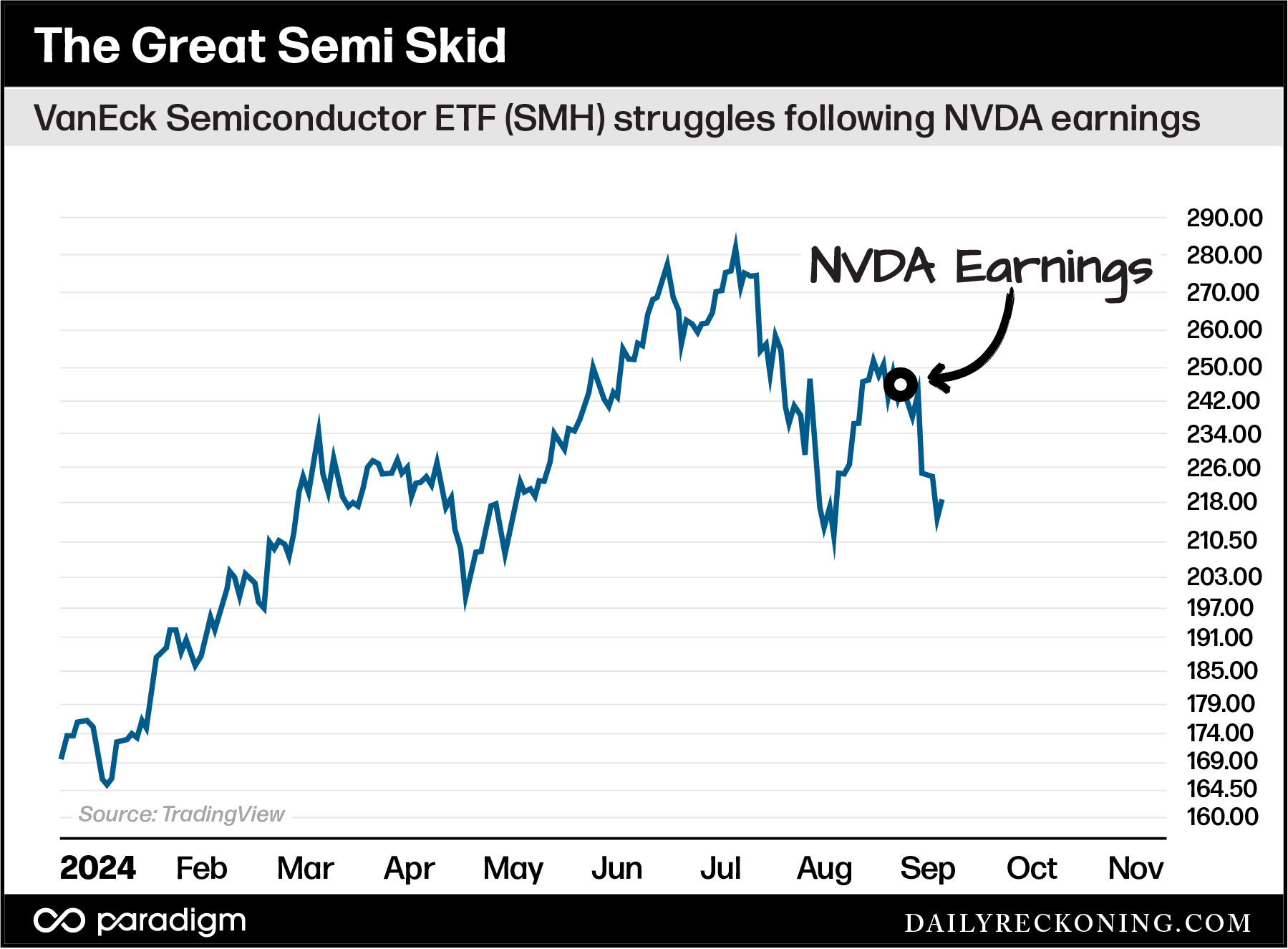

This post ?All I see is Red? appeared first on Daily Reckoning. September strikes again! After just a handful of trading days, I'm here to report that this month is going much like many investors feared? Stocks are skidding lower at an alarming rate so far this month and traders are running for cover, buying up safety trades like utilities and consumer staples names as tech stocks and other popular plays continue to dive. The post-Labor Day malaise has been absolutely brutal so far ? especially since it's coming on the heels of the record-breaking August snapback. The S&P 500 went from sneaking up on new highs to dropping more than 4% in just four trading days during the holiday-shortened week. Brutal. First and foremost, it's important to remember seasonality is working against the bulls right now. September is a historically volatile month. And it's clear investors are a bit rattled right now (The early August Yen panic isn't helping, either). But the world isn't ending just yet. Yes, it's true ? stocks have gotten off on the wrong foot. My screen was red almost everywhere I looked last week, and we witnessed a tentative, back-and-forth bounce to begin the new trading week. I think there are a couple of key reasons why investors are dumping stocks right now. First, the most popular (and visible) stocks on the market have been underperforming for weeks. Yes, I'm talking about semiconductors. NVDA has sucked all the air out of the room since breaking out in early January. Not a second of market coverage could pass on the financial news without discussing this world-beating stock's performance. But NVDA hasn't posted a new high since June. Shares have also dropped as much as 20% since the company announced strong earnings late last month. Naturally, the other chip stocks have mostly failed to gain traction while NVDA struggled. In fact, many other high-profile semi-stocks topped out well before NVDA's slump began. The VanEck Semiconductor ETF (SMH) is down 15% from its August highs ? and 23% removed from those all-time highs set back in July.

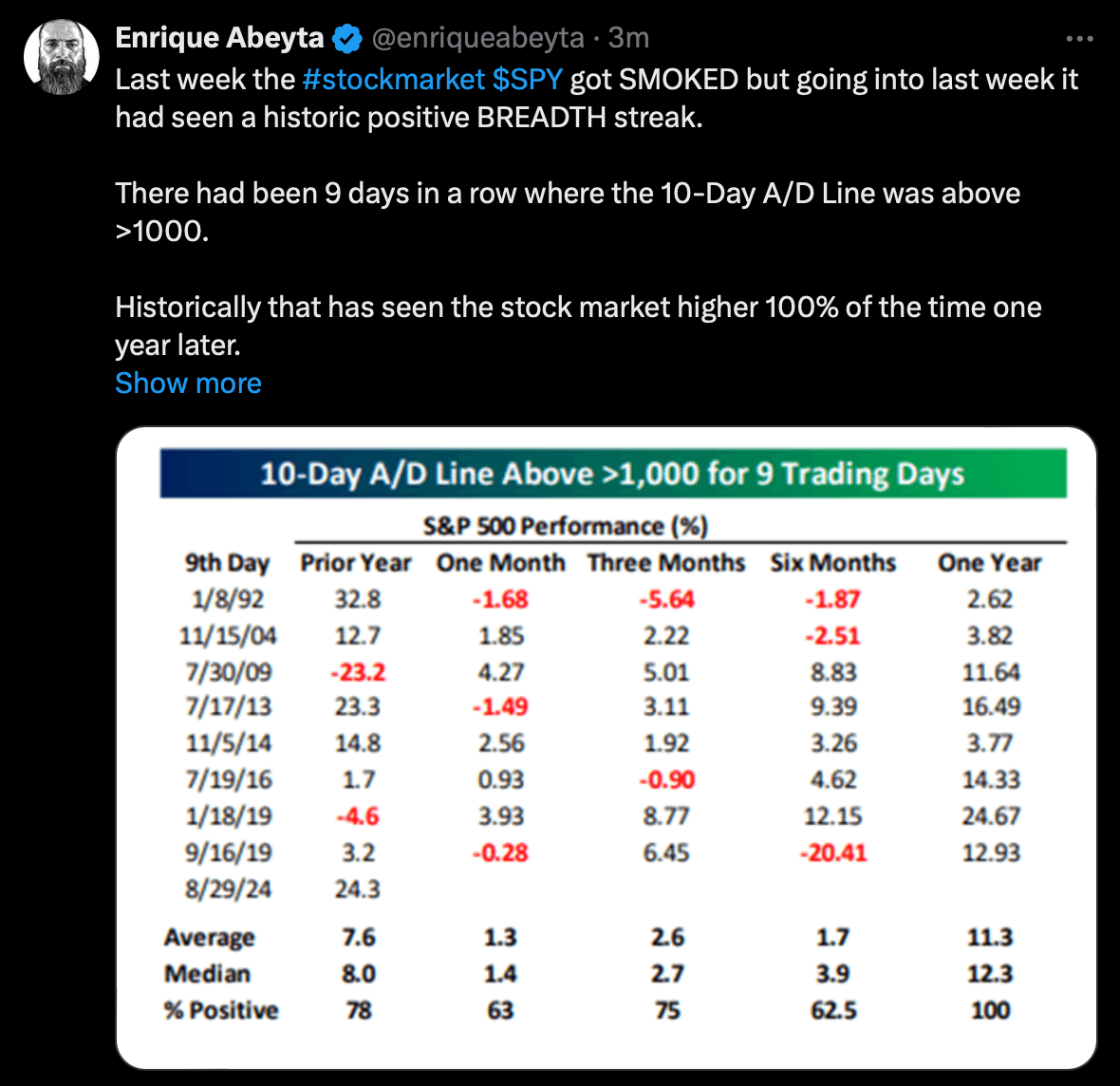

It's difficult to convince the herd that everything's gonna be alright when the one stock that has dominated the tape for the better part of the past eight months needs to take a break and maybe even *gasp* find some support levels and chop along for a bit to digest its recent gains. Still, it's tough to imagine the market holding up when its most popular name has hit the skids. All the more reason for folks to flip bearish? Next up: I believe a bit more uncertainty has crept back into the picture. Obviously, the future is never certain ? especially not when it comes to markets. But investors love to pretend that they know what will happen next. This little act is getting more difficult to pull off right now because we're collectively focusing our concerns away from inflation and back toward whether this whole soft landing ordeal is going to work out. Here's a telling passage from a recent WSJ piece on the recent market jitters: ?Six months ago we had a zero risk of recession,? says Johanna Kyrklund, chief investment officer at Schroders. Now there is a risk, she says, that weakness among lower-income households starts to affect the rest of the economy. The market's nervous ticks are now dictated by every little piece of economic data hitting the wire. Unfortunately, we're running the gauntlet again this week: CPI hits the wire Wednesday morning, followed by PPI on Wednesday. Again, maybe inflation isn't the big worry here. Instead, investors want to know if the economy is holding up? and not sputtering toward recession. Then, we have the main event! The Fed's first rate cut is coming in less than two weeks. Barring some surprise numbers, it's looking like we'll probably see a 25-bps cut next Wednesday. But until we hear it straight from Powell's mouth, the noise is going to get louder? Did the Bears Jump the Gun?Sentiment is also changing incredibly fast. Everyone was bulled up at the end of August following the miraculous recovery from the Yen panic lows. The mood quickly soured last week and investors are now expecting the worst. The truth, as always, is probably somewhere in between. For now, it would be prudent to remain cautious and give the market room to work out some of this angst. Anything can happen ? but I would not expect an all-out meltdown at this time. The market's in flux. Investors are rapidly adjusting their expectations. And many former market leaders are slipping. Yet there's still positive action under the surface. Check out the stats from our friend Enrique as he breaks down September's historically bad start:

While we have witnessed an ugly drop during the first week of the month, there's plenty of bullish data to fall back on. For starters, the market was looking constructive heading into the month. Market breadth was expanding (a fact we noted numerous times during the August snapback). As Enrique explains, expanding breadth is a reliable sign that the market will be higher following these bouts of turbulence. That's great news for longer-term-minded investors. We don't need to jump the gun and try to pick a bottom here just yet. Keep it simple! Let the market have its little tantrum, then wait to see if we get a failed move lower heading into October (perhaps a washout following the expected Sept. 18 rate cut?). If the expanding bull market over the summer was correct, we should see a meaningful bounce during the fourth quarter. Keep the bear suit in the closet for now? The post ?All I see is Red? appeared first on Daily Reckoning. |